State Bank of India is the largest public sector bank of the country. The bank is ranked in the list of biggest corporations in the world in 2019. With its headquarters in Mumbai, the State Bank of India was founded in 1806 as Bank of Calcutta. Its name and operational functions changed gradually after that. The bank offers one of the finest services in the banking sector, providing Debit Card services is one of them.

Customers withdraw money from the ATM as per their convenience. But some of them need to withdraw amount more than the limit offered in their Debit Card. Sometimes on the occasion of festival and family function or in case of emergency individuals need to withdraw a big amount of money. In that situation, your SBI Debit Card limits you for doing that. However, the bank has different cash withdrawal limits on certain debit cards and you can also increase your SBI debit card limit.

Increase ATM card limit online

Here we are providing a step by step guide which you can follow to successfully increase your SBI ATM card limit.

Step 1. Go to SBI official net banking website.

Step 2. Continue to Login and enter your credentials in Username and Password field, then Login to your account.

Step 3. Now select the e-Services option from the top menu.

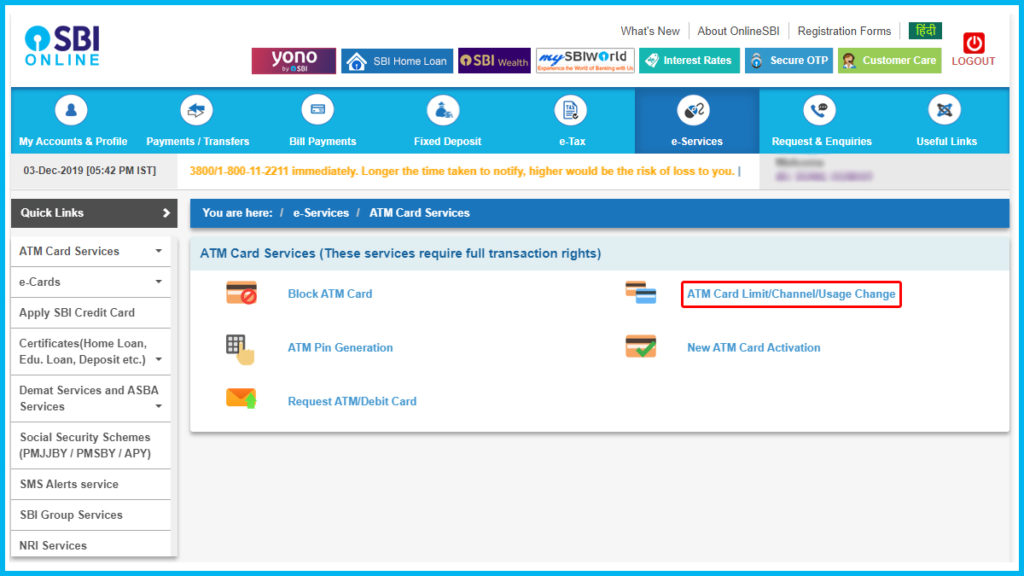

Step 4. Select ATM Card Services from the list.

Step 5. Choose the ATM Card Limit/Channel/Usage Change option from the display options.

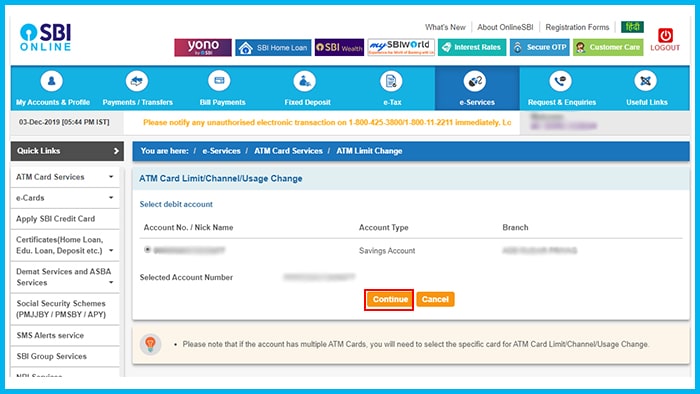

Step 6. Now select the Debit Account and cross-check all the details then click on Continue.

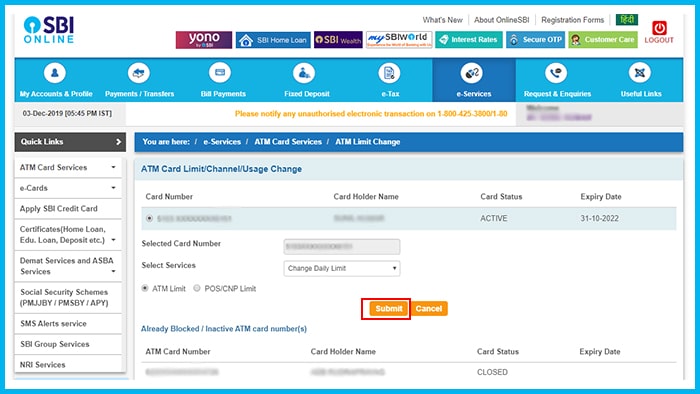

Step 7. Choose the card of which limit you want to change and select Change Daily Limit from Select Services option.

Step 8. Check the ATM Limit option and click on Submit.

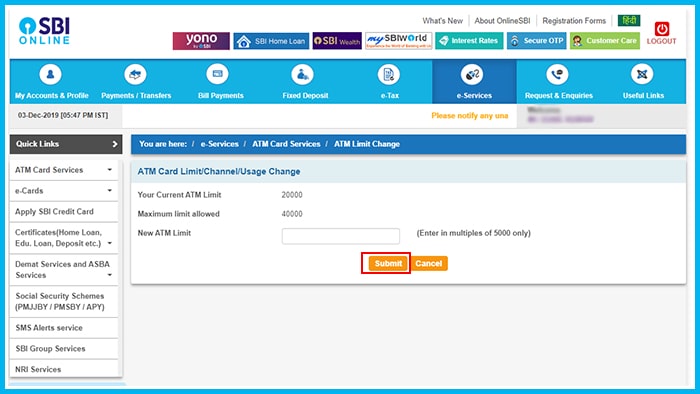

Step 9. Now you will see Your Current ATM Limit, enter the New ATM Limit and click on Submit.

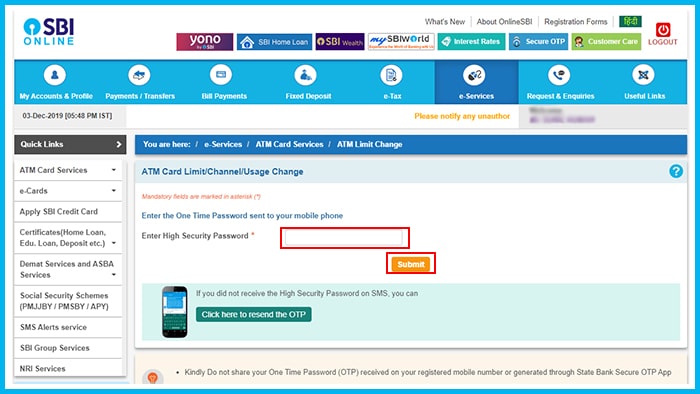

Step 10. You will receive an OTP on your registered mobile number which you need to enter on the display screen and click on Submit.

A message stating successful modification will appear if all steps are done correctly.

*Keep that in mind that this limit cannot be more than the limit available on your SBI debit card. Certain cards have different limits.

If you want to apply for a new SBI debit card read the process to apply new SBI debit card online. Here we have provided all the details to request new Debit Card from your branch or through Net Banking.

Below are the details of Debit Cards offered by the State Bank of India with their daily limits and special features.

SBI debit card options

The bank provides a wide range of debit cards to choose from. You select one according to your needs and necessity. We are covering all of SBI’s debit cards one by one.

| Card Name | Daily Cash Withdrawal Limit | Maintenance Charges | Other Features | ||

| ATM cash limit | Online transactions | Annual Maintenance charges | Card replacement charges | ||

| SBI Classic Debit Card | Min- Rs.100 Max- Rs. 20,000 | Min- No limit Max- Rs. 50,000 | Rs.125+GST | Rs.300+GST | Ideal for shopping at over 5 lakh outlets, Master Secure Code security on online purchases. |

| SBI Global International Debit Card | Min- Rs.100 Max- Rs.40,000 (varies from country to country) | Min- No limit Max- Rs.75,000 (varies from country to country) | Rs.175+GST | Rs.300+GST | Ideal for shopping at over 6 lakh in India and 30 million worldwide merchant outlets, Master Secure Code security on online purchases. |

| SBI Gold International Debit Card | Min- Rs.100 Max- Rs.50,000 (varies from country to country) | Min- No limit Max- Rs.2,00,000 (varies from country to country) | Rs.175+GST | Rs.300+GST | SBI Rewardz system where 1 SBI Rewardz point for every Rs.200 spent on shop, dinner, fuel or spend online. |

| SBI Platinum International Debit Card | Min- Rs.100 Max- Rs.1,00,000 (varies from country to country) | Min- No limit Max- Rs.2,00,000 (varies from country to country) | Rs.175+GST | Rs.300+GST | SBI Rewardz system where 1 SBI Rewardz point for every Rs.200 spent on shop, travel booking, fuel or spend online. |

| sbiINTOUCH Tap & Go Debit Card | Min- Rs.100 Max- Rs.40,000 (varies from country to country) | Min- No limit Max- Rs.75,000 (varies from country to country) | Rs.175+GST | Rs.300+GST | NFC technology contactless transactions, shopping at over 10 lakh merchant outlets in India and over 30 million worldwide. |

| SBI My Card International Debit Card | Min- Rs.100 Max- Rs. 40,000 (varies from country to country) | Min- No limit Max- Rs.75,000 (varies from country to country) | Rs.175+GST | No replacement against loss, you can apply for new @Rs.250+GST | Customized card with images, contactless technology, shopping at over 6 lakh merchant outlets in India and over 30 million worldwide. |

| State Bank Premium | Max- Rs.2,00,000 (varies from country to country) | Max- Rs.5,00,000 (varies from country to country) | Rs.350+GST | Rs.300+GST | High cash withdrawal limit, SBI Rewardz system where 1 SBI Rewardz point for every Rs.200 spent on shop, travel booking, fuel or spend online. |

| State Bank Pride | Max- Rs. 1,00,000 (varies from country to country) | Max- Rs. 2,00,000 (varies from country to country) | Rs.350+GST | Rs.300+GST | High cash withdrawal limit, SBI Rewardz system where 1 SBI Rewardz point for every Rs.200 spent on shop, travel booking, fuel or spend online. |

State Bank of India has 40,000+ ATMs across India. The above-listed cards will determine the cash withdrawal limit of your card. All the card information listed is sourced from SBI official website.

SBI new rules on debit cards

State Bank of India will deactivate all ATM cum debit cards which have magnetic stripe by 31 December 2019. The bank announced this on its twitter handle and also on the official website. As per RBI, guidelines, State Bank of India will replace all Magstripe cards with EMV chips and PIN-based cards.

According to SBI tweet, “Apply now to change your Magnetic Stripe Debit Cards to the more secure EMV Chip and PIN-based SBI Debit card at your home branch by 31st December 2019. Safeguard yourself with guaranteed authenticity, greater security for online payments and added security against fraud.”

EMV (Europay, MasterCard and Visa) debit cards are more secure and convenient than magnetic stripe cards. The inbuilt microprocessor chip stores the cardholder’s data and protects it from unauthorized activities.

The Reserve Bank of India ordered all banks to replace the magstripe cards with new EMV cards. The last date to act in accordance with the order was 31st December 2018.