Death can be unpredictable which makes us realize the importance of an insurance policy. This can be problematic especially if an earning member has been killed. It can not only emotionally challenging but also financially.

Although the personal loss cannot be compensated, the financial loss of the earning member can be taken care of if you take the right step at the right time. You can safeguard the financial security of your family even after your death using an insurance policy.

One such insurance policy is LIC’s New Jeevan Anand Plan that provides you a safety net of insurance. In this article, we will discuss LIC New Jeevan Anand Plan Table 915, benefits, maturity benefits, eligibility, etc.

What is LIC New Jeevan Anand Policy?

LIC New Jeevan Anand Policy is a non-linked life assurance plan for individual who wants to enjoy the protection of an insurance policy as well as earn savings benefits.

In case of your death, your family will get insurance money and if you survive, you’ll get a lump sum amount after the policy achieved maturity.

LIC Jeevan Anand Table 915 Policy Benefits

The following are the benefits of LIC Jeevan Anand Policy-

Death Benefits

During the policy Terms

Your family will enjoy the death benefits in case of your death. Your family will receive “Sum assured on death” plus a vested simple revisionary bonus along with a final additional bonus.

Death Benefit= Sum Assured on Death + Vested Simple Recessionary Bonuses + Final Additional Bonus

The sum assured is 125% of the Basic sum assured or 7 times of annualized premium whichever is higher. The death benefits will not be less than 105% of the premium paid up to the death of the Individual.

Maturity Benefits

After the policy has attained maturity, you’ll be entitled to receive the maturity benefits which are Sum Assured on maturity plus vested revisionary bonus and Final Bonus. The Sum assured on maturity is equal to the basic sum assured.

Maturity Benefit= Sum Assured on Maturity+ Vested Simple Recessionary Bonuses + Final Additional Bonus

Optional Benefits

You also have an option to enable the optional benefit provided by the new Jeevan Anand Policy by availing of the following options-

Rider’s Benefit

Rider benefits are those additional benefits that the policyholder gets in case of an accident while driving. The following are the different rider’s policies that you can buy by paying additional premium amounts-

- LIC’s Accidental Death and Disability Benefit Rider (UIN: 512B209V02) or LIC’s Accident Benefit Rider (UIN:512B203V03)

- LIC’s New Term Assurance Rider (UIN: 512B210V01)

- LIC’s New Critical Illness Benefit Rider (UIN: 512A212V01)

Option to take Death and Maturity Benefit in Installment

The policyholder or the nominee of the policy has the option to receive the monthly installment of the maturity or death claim if he/she wishes to. The following are the minimum amount of installment one will receive-

| Mode of Instalment payment | Minimum installment amount |

| Monthly | Rs.5,000/- |

| Quarterly | Rs.15,000/- |

| Half-Yearly | Rs.25,000/- |

| Yearly | Rs.50,000/- |

Eligibility Criteria for LIC New Jeevan Anand Policy

The following are the eligibility criteria for LIC New Jeevan Anand Policy-

| Terms | Conditions |

| Minimum Basic Sum Assured | 100000 |

| Maximum Basic Sum Assured | No Limit |

| Minimum Age at entry | 18 years |

| Maximum Age at entry | 50 years |

| Maximum Maturity | Age 75 years |

| Minimum Policy | Term 15 years |

| Maximum Policy | Term 35 years |

Premium Payment for LIC Jeevan Anand Table no. 915

The policyholder has an option to pay the premium amount in multiple modes like monthly, quarterly, half-yearly, or yearly.

Grace Period

Grace Period is a time limit in which the policyholder has defaulted for the premium payment but, the policy is still in force. In this case, a grace period of 30 days in case of quarterly, yearly, or half-yearly premium is to be paid or 15 days in case of monthly premiums.

Rebates

Rebates are the refunds that the policyholder receives in case of payment of the premiums in a certain premium amount. The following are the rebate table for the premium payments and the sum assured rebate on premiums-

| Yearly mode | 2% of Tabular Premium |

| Half-yearly mode | 1% of Tabular premium |

| Quarterly, Monthly mode & Salary Deduction | NIL |

High-sum assured rebate on premiums-

| Basic Sum Assured (B.S.A) | Rebate (`) |

| 1, 00,000 to 1, 95,000 | Nil |

| 2, 00,000 to 4, 95,000 | 1.50% of B.S.A. |

| 5, 00,000 and 9, 95,000 | 2.50% of B.S.A. |

| 10, 00,000 and above | 3.00% of B.S.A. |

Revival for LIC Jeevan Anand Table no. 915

If the premiums are not paid on time during the grace period, then the policy will lapse. A lapsed policy can be revived within 5 years from the date of the first payment of the premium. For reviving the policy, the policyholder must pay all the pending premiums along with the interest compounded half-yearly to the corporation. The corporation will decide the interest rate best suitable as per the corporation.

Tax on LIC Jeevan Anand Table no. 915

The LIC Jeevan Anand Policy offers tax benefit on the premium paid for the policy under the Income Tax Act, Section 80C.

The maturity amount of the policy is tax-free however, under certain circumstances, which is, the bonus amount must be 10% of Sum Assured anything more than 10% will be charged with tax as per the directive of the Income-tax department.

Loan

The policyholder can also avail of a loan against their policy. LIC policy acts as collateral for the loan taken. The loan interest and amount will be provided by the corporation only. You can contact your insurance agent or LIC customer care to inquire about the amount of the loan.

Usually, the following are the amount provided as a loan to the policyholder-

- For in-force policies – up to 90% of Surrender Value

- For paid-up policies – up to 80% of Surrender Value

Paid-up Policy

After the grace period, the policy will collapse fully if the premium paid is less than 2 years, but, if the premiums were paid more than 2 years then the policy will be converted into a paid-up policy which is as follows-

Death of Policyholder

In case of the death of the policyholder during the paid-up policy period the sum assured on death will be reduced to Death Paid-up Sum Assured. In addition, a vested revisionary bonus will also be paid.

Maturity of Policyholder

In case of the Maturity of the policy after the policy is converted into a Paid-up policy, the sum assured on maturity will be reduced to Maturity Paid-up Sum Assured. In addition, a vested revisionary bonus will also be paid.

Free Look-Up Period for LIC Jeevan Anand Table no. 915

The free look-up period is 15 days period provided to the policyholder for opting out of the policy if he/she changes their mind due to some terms and conditions. If the policyholder opt-out of this, then the initial premium paid will be returned to the policyholder after deducting the documentation charges.

Surrender

You can surrender your policy after paying two years of premiums. In this case, you’ll receive Guaranteed Surrender Value or Special Surrender Value, whichever is higher. It is calculated by the corporation and depends on the premium paid.

Exclusion

The policy will become null and void if the policyholder commits suicide and in this case, only 80% of the total sum assured will be paid provided that the policy was in force. In case of more than 12 months, 80% of the sum assured or death or surrender value will be provided.

LIC Jeevan Anand with Example Chart

To understand the LIC Jeevan Anand Policy, an example of both maturity benefit and the death benefit is explained through a LIC New Jeevan Anand chart that will provide you with an overview of how you will be paid for the availing this policy year wise

Rahul is availing of the LIC Jeevan Anand Plan for himself and paying a monthly premium of Rs. 3614/- for the LIC Jeevan Anand policy. The following Jeevan Anand Chart shows the benefit that is provided to him for both maturity and death claims-

Maturity Claim Benefit

When calculating the maturity amount, we have to assume that Rahul never took a loan and has paid all premiums on time. The following chart will show us the maturity amount for the monthly premium paid by Rahul-

| Maturity Year | 2044 |

| Age at Maturity | 46 |

| Sum Assured (A) | 1000000 |

| Bonus (Approx) (B) | 1675000 |

| Total Maturity (A+B) | 2675000 |

The above Jeevan Anand Chart shows Rahul who availed the policy when he was 18 for a period of 25 years. The policy maturity year is 2044 when he will be 46 years of age. When we add all the premium paid by Rahul the amount comes out to be Rs.10,84,200/- and the maturity amount is Rs 26,75,000 so the overall ROI is 146.73% which is very good and this is the reason for this policy to be one of the best selling policy of LIC. Another benefit of this policy is that after maturity the risk covered will still be in effect meaning the risk covered amount after maturity, in this case, will be Rs. 10,00,000/-.

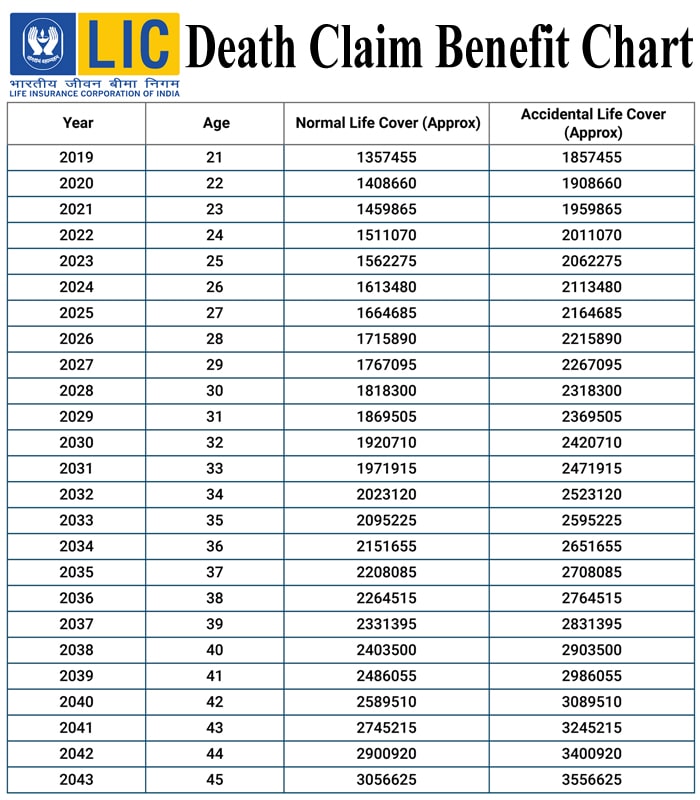

Death Claim Benefit

LIC Jeevan Anand Policy will provide the death benefit which will be equal to the 125% of Sum Assured + Bonus + Final Addition Bonus (FAB) is paid to the nominee and it is indicated as Normal Life Cover. In case of accidental death, an additional amount equal to the sum assured is also added to the death claim amount which is called Accidental Life Cover. The following Jeevan Anand Chart shows you the Normal Life Cover and Accidental Life Covers-

| Year | Age | Normal Life Cover (Approx) | Accidental Life Cover (Approx) |

|---|---|---|---|

| 2019 | 21 | 1299000 | 1799000 |

| 2020 | 22 | 1348000 | 1848000 |

| 2021 | 23 | 1397000 | 1897000 |

| 2022 | 24 | 1446000 | 1946000 |

| 2023 | 25 | 1495000 | 1995000 |

| 2024 | 26 | 1544000 | 2044000 |

| 2025 | 27 | 1593000 | 2093000 |

| 2026 | 28 | 1642000 | 2142000 |

| 2027 | 29 | 1691000 | 2191000 |

| 2028 | 30 | 1740000 | 2240000 |

| 2029 | 31 | 1789000 | 2289000 |

| 2030 | 32 | 1838000 | 2338000 |

| 2031 | 33 | 1887000 | 2387000 |

| 2032 | 34 | 1936000 | 2436000 |

| 2033 | 35 | 2005000 | 2505000 |

| 2034 | 36 | 2059000 | 2559000 |

| 2035 | 37 | 2113000 | 2613000 |

| 2036 | 38 | 2167000 | 2667000 |

| 2037 | 39 | 2231000 | 2731000 |

| 2038 | 40 | 2300000 | 2800000 |

| 2039 | 41 | 2379000 | 2879000 |

| 2040 | 42 | 2478000 | 2978000 |

| 2041 | 43 | 2627000 | 3127000 |

| 2042 | 44 | 2776000 | 3276000 |

| 2043 | 45 | 2925000 | 3425000 |

The above calculation is an approximate value and can vary from year to year. The Bonus & Final Addition Bonus are subject to change and are decided by the corporation.

You can also see the same example for the premium paid for the same sum assured. The premium paid for the LIC Jeevan Anand policy is Rs. 41,874/- which is paid yearly. The following LIC Jeevan Anand Chart will show you the Normal Life Cover and Accidental Life Covers when the policy premiums are paid yearly-