The Indian Financial System Code (IFSC) is a unique 11-character alphanumeric code. IFSC Code is used to identify individual bank branches in India that participate in the electronic payment system. The electronic payment system is maintained by the Reserve Bank of India (RBI).

With 12 public sector banks and over 100 other banks, there are over 1,70,000 IFSC codes representing bank branches.

It is a crucial component for facilitating electronic fund transfers such as NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service).

The IFSC code ensures secure, efficient, and error-free transactions. It uniquely identifies the sender’s and recipient’s banks and branches. It plays a vital role in streamlining India’s digital banking system. It’s mandatory for most electronic payment systems in India.

Format of an IFSC Code

An IFSC code is structured as follows:

- The first 4 characters represent the bank name (alphabetic).

- The 5th character is always ‘0’ and reserved for future use.

- The last 6 characters identify the specific branch (alphanumeric).

Example:

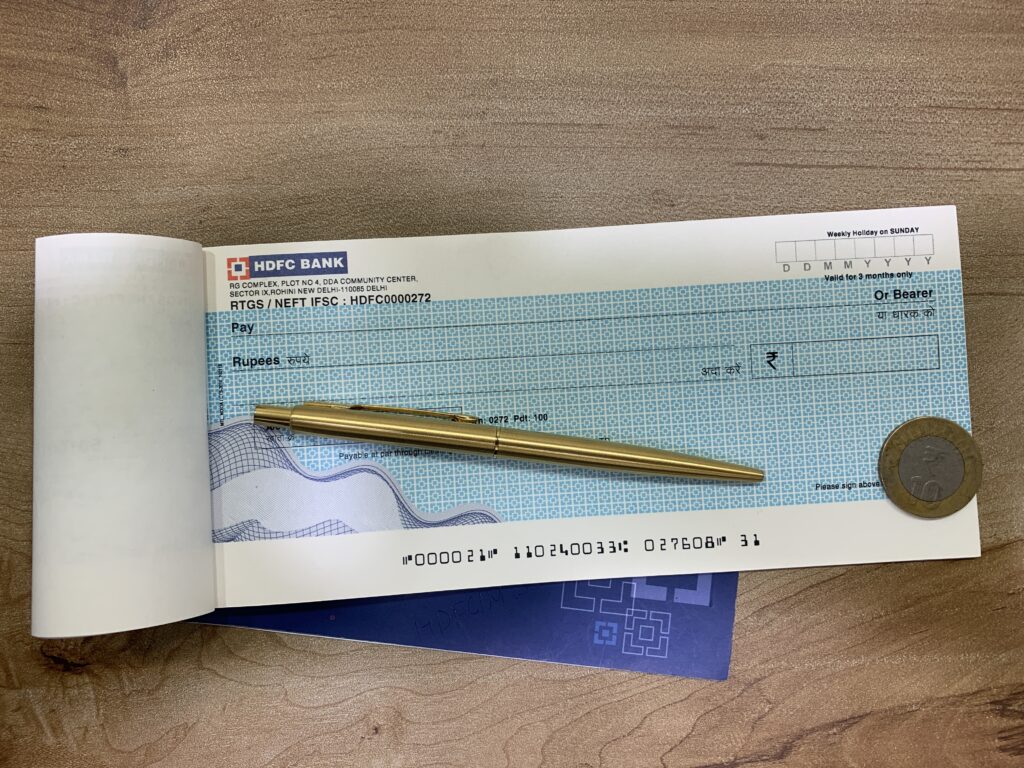

In the above HDFC Bank’s check book, you can see the 11 digit IFSC Code as HDFC0000272.

- “HDFC” denotes the bank (HDFC Bank Ltd).

- “000272” represents the branch (Sector IX, Rohini, Delhi).

History of the IFSC Code in India

RBI introduced IFSC back in 2004 as a need to take the banking electronics way. The role of IFSC code was to set the banking system to real-time electronic payments.

Before the introduction of the IFSC code, banking was heavily dependent on paper-based transactions. Later with NEFT, RTGS, and IMPS used in inter-bank settlements started working on the foundation of the IFSC system.

IFSC Codes gained significance after the government’s initiatives such as Digital India in 2010.

With the increase of smartphones and the internet, millions of Indians moved towards digital payments.

The Unified Payments Interface (UPI) was introduced in 2016. It revolutionizing digital transactions in India. The IFSC system once again demonstrated its importance as the backbone of UPI-based payments.

Role of IFSC in the Indian Banking System

IFSC system has been the backbone of the Indian banking system for two decades. It has been so innovative that with every innovation in banking, it could not be ignored.

Simplifying Transactions:

IFSC allows easy identification of bank branches. It ensures that funds are transferred accurately and efficiently.

Enabling Digital Growth:

With the rise of NEFT, RTGS, and IMPS, the need for a standardized branch identification system became critical. IFSC paved the way for seamless integration across all banks.

Boosting Financial Inclusion:

The IFSC codes helped the expansion of financial services to rural and semi-urban areas. , It allowed small branches to participate in the electronic payment ecosystem.

FAQs

An IFSC (Indian Financial System Code) is a unique 11-character code assigned to each bank branch in India by the Reserve Bank of India. It is essential for electronic fund transfers like NEFT, RTGS, and IMPS, ensuring that funds are sent to the correct bank.

You can find any bank IFSC code at your cheque book, in your bank passbook or account statement and at Ask Bank IFSC Tool.

No, each bank branch has a unique IFSC Code. Even branches of the same bank in different locations will have different codes to ensure accurate identification during electronic fund transfers.

No, UPI (Unified Payments Interface) transactions do not require an IFSC code, as they are linked to mobile numbers or UPI IDs. However, IFSC codes are mandatory for NEFT, RTGS, and IMPS transactions.

If you have entered wrong IFSC code while fund transfer, the transaction will be failed.

When your account gets transferred, your IFSC code is also changed.

RBI has allotted more than 1,70,000 IFSC codes.