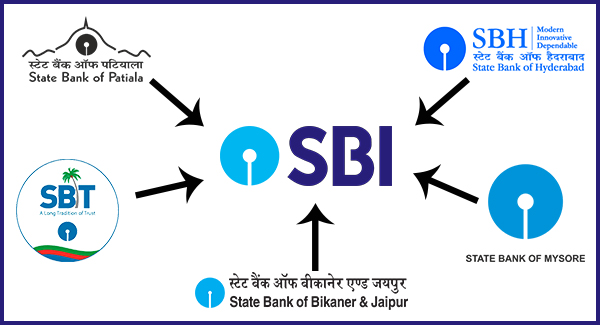

The well-known merger of the State Bank of India with its 5 associate banks State Bank of Bikaner and Jaipur, State Bank of Patiala, State Bank of Hyderabad (SBH), State Bank of Travancore (SBT) and State Bank of Mysore was officially announced on April 1, 2017.

The big State Bank of India merger has now encountered its first roadblocks in the form of resistance from the employees of SBM, SBH and SBT in their respective states. The employees of the SBT have moved the Madras High Court and were successful in obtaining an order for status quo to be maintained on schemes for pension, seniority and benefits of the migrant employees. The Hyderabad High Court has asked the SBI not to finalise the merger unless the employee options are re-considered. There is unrest among the subsidiary bank employees regarding the hierarchy of management after the merger.

The merger calls for a major restructuring of the bank management which is bound to unearth inconvenient events in the near future.

The big plus aimed with this merger is the admission of the SBI to the G-SIB club. The SBI can now boast of a balance sheet size of Rs. 41 lakh crore. This will improve its ranking in the Bloomberg listing of banks by its asset value. According to SBI chairperson Arundhati Bhattacharya, SBI will be among the top 50 global banks post-merger based on its asset value. She adds that the annual profits within next three years will get a boost of about Rs. 3000 crore. The forecast for loan growth for the current financial year is at 11%, as opposed to the observed percentage of 6.5% this year end.

The Big Benefits to reap from this move:

The cost rationalisation process which will provide operational cost savings after the completion of merger process is the big plus point which encouraged this merger. The stronger capital base of all the SBI and its associate banks after the successful merger is another strong plus point. This merger stands to carve a strong foothold for the SBI in the banking sector. An increase in the market share from 17% to 23% will ensure that the SBI will be able to give tough competition to the private banks with its 370 million customer base, 58,000 ATM vending outlets and 22,500 branches.

This merger also aims to provide greater operational benefits to the customers at no additional cost as the Core Banking System is already implemented. The borrowers from the subsidiary banks will stand to gain the benefits of reduced lending rate at 8.65% which otherwise would be anywhere between 8.85% and 9.2%.

The Negative Reactions:

The rationalisation process for optimising the operational efficiency may close some overlapping banks in an area. This is the reason VRS schemes were offered to the employees of the associate banks. Of the 12,000 eligible employees about 2800 accepted the VRS schemes offered by the SBI to its associate bank employees. The main caveat of the merger as spoken from the employee side is the closure of about 24,000 branches of the subsidiary banks which caused dissatisfaction among 2,71,765 employees.

The senior employees of the associate banks who have served for 10 or more years will again be considered as new employment in the parent SBI bank. In a pointer, the SBI has made it clear that the associate bank employees are not eligible for the SBA and SCA which the regular SBI employees enjoy. This move may provoke many experienced employees to opt for the VRS scheme.

Certain employee unions have moved the state High Court; contrarily about 2,800 employees have accepted the VRS offer. Recently, the employees of SBH moved the High court in Hyderabad to reconsider the employee options. The High court has asked the SBI not to finalise the merger unless the employee options submitted by subsidiary bank officers are considered and acted upon by June 15th. The employees fear that the new hierarchy of the employee may not be practical after the merger.

A Hopeful future:

The anticipated improvement in market share and an increase in the asset value for all the banks involved in the merger make the shareholders of the subsidiary banks look forward to this big move. The share swap options for the shareholders of the SBBJ, SBT and SBM associate banks currently nurture positive reactions for the merger. The expected plus in the form of improved shareholder premium percentage may turn zero if the expected asset capital of merger does not reflect in the share price after the merger. This also brings us to the most important aspect of bad loan balloon. In the wake of the SBI announcing student scholar loans covering 100% amount up to Rs. 30 Lakh, the loan balloon is expected to expand rapidly. The improved coverage ratio is yet to be divulged by the bank, followed by the post-merger NPA value. The bank expects to reap the benefits of the merger during the third quarter of 2017-18.