State Bank of India is India’s biggest bank with over 24,000 bank branches. To increase the outreach even further, the bank provides an online account opening feature.

You can now apply online to open a bank account, this is not fully online. You still have to visit the bank branch for physical verification but, the process will be fast-tracked.

It is much more convenient for the user as most of the banking process will be done before the verification of the applicant.

In this guide, we will explain to you a step-by-step process on how to open SBI Account Online, the application process, documents required, etc.

But first, let’s find out what are the different types of SBI bank account that you can apply for online.

Type of Bank Account in SBI

There are different types of SBI bank accounts that you can apply online but, you can divide them into two categories which are as follows-

Savings Bank Account

A Savings Bank Account is a bank account that you can use to deposit and withdraw funds all while earning interest.

This is a general account that almost every individual has. SBI offers different savings bank account depending on the individual’s needs.

The following are the savings bank account types that you can apply for online-

- SBI NRE/NRO Savings Account (for Non-Resident of India)

- SBI Resident Individual Savings Account (for Resident of India)

Current Bank Account

A Current Account is a bank account that you use for your business operations. You do not earn any interest for the deposited amount but, the Current Account user gets premium services for the business operations.

How to Open SBI Bank Account Online?

You can open an SBI bank account online using the following step by step method-

- Visit the official website of online SBI by following this link- https://www.onlinesbi.com/

- Now, navigate towards the “Apply SB/Current Account” tab and choose the type of account you want to apply for

- The application process is almost the same for all the accounts but, the document requirement and features of the account will differ

- After selecting the type of account, a form will appear which is divided into two different parts-

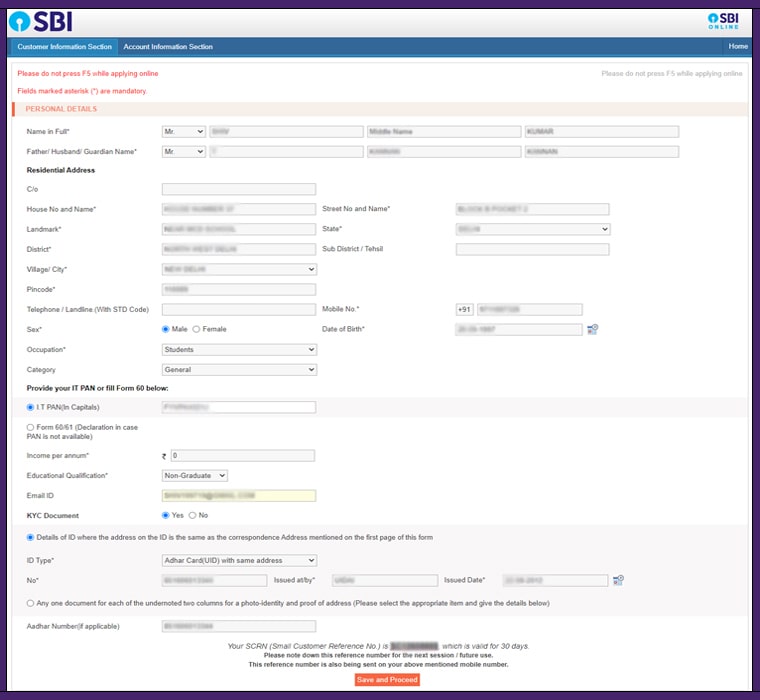

Part-A Customer Information Form

- After clicking on the customer information form button, a new form will appear where you have to provide your details

- You have to fill in your name, father name, address, and other information related to you

- After filling in the information, you have to click on the submit button

- Now an SCRN number will be provided to you, make sure you keep this number safe

- Click on the save and proceed button followed by stating yes or not for adding another applicant (for Joint Account) and click on proceed button

- After clicking the proceed button, you will be redirected to Par-B of the application form i.e. Account Information Form

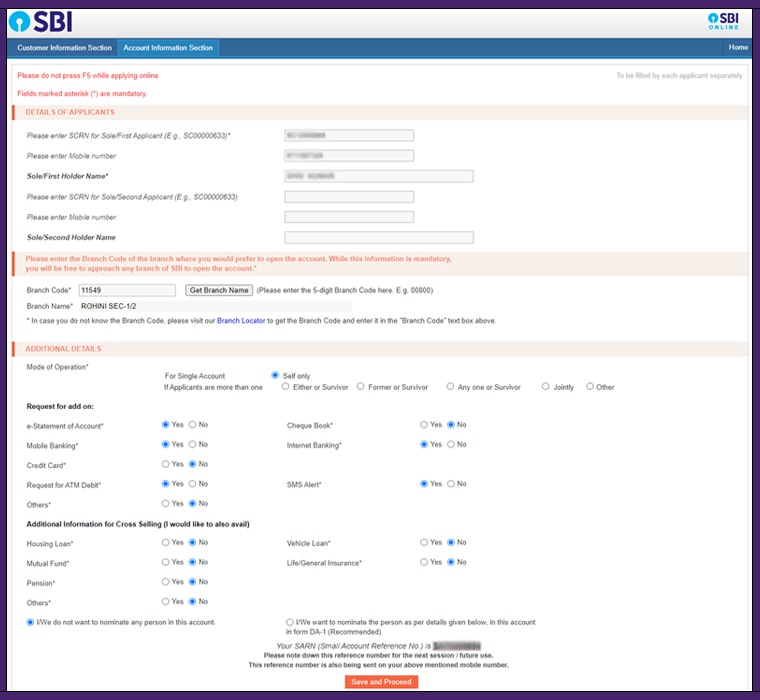

Part-B Account Information Form

- Now, A new form will appear where you have to enter your SCRN number followed by entering mobile number and account holder name

- Now use the branch code to search for your neared bank branch. You can use AskBankIFSCCode search to find your nearest SBI bank branch code

- Now, click on the get branch name button start answering the yes or no option for the services you would need from the bank like a credit card, debit card, internet banking, etc.

- Click on the proceed button and a new SARN number will be generated that you have to save for future use

- Now you have successfully submitted your account opening form online

Post Application Process

- After filling in the application online, you have to download the filled application form from the main page

- Now, visit your nearest SBI bank branch and submit the downloaded application form along with a Xerox copy of the documents mentioned below

- Make sure you are also carrying original documents of the same

- Submit the application, you will be notified right away about the account opening status also make sure you are carrying the initial deposit amount as well

- Now, within 5-7 working days, you will receive a letter from the bank that will carry the account starter’s kit which includes debit card, internet banking login details, etc.

- You have successfully created your bank account online

Documents Required for Opening SBI Bank Account

The following are the documents required for opening SBI Bank Account

Savings Bank Account

For opening Saving Bank Account, the applicant must produce anyone of the document from Proof of Identity and Address. The following are the list of documents that you can produce while opening a bank account-

Proof of Identity

- Passport Size photograph

- Passport

- Voter’s Identity Card

- Driving Licence

- Identity cards issued by Post offices

- Identity cards issued by Public authorities

- Aadhaar Letter/Card

- NREGA Card

- Pension Payment orders

Proof of Address

- Passport

- Voter’s Identity Card

- Driving Licence

- Aadhaar Letter /Card

- Identity cards issued by Public authorities

- Photo identity cards issued to bonafide students by a university

- Govt./Defence ID Card

- ID Cards issued by reputed employers

- NREGA Card

- Pension Payment orders

- Identity cards issued by Post offices

- PAN Card

- Telephone bill (not more than 3 months old)

- Bank account Statement (Not more than 3 months old)

- Letter from any recognized public authority

- Electricity bill (not more than 6 months old)

- Copies of Registered Leave & License agreement/ Sale Deed/Lease Agreement Letter issued to students by Hostel warden of the University/ I Institute, where the student resides, duly countersigned by the Registrar/ Principal/Dean of Student Welfare

- In the case of students/ close relatives, identity and address of the relative whom they are staying along with the declaration from such person.

- Ration card

- Letter from reputed employer Income Tax/ Wealth Tax Assessment orders

- Credit Card Statement (not more than 3 months old)

Current Bank Account

For opening a Current Account, the applicant is required to produce all the documents mentioned above but, an additional set of documents are also required which are related to your business. The following are the list of documents that you have to produce while applying for your current bank account-

Sole Proprietorship Firm

- Identity Proof (PAN Card, Aadhar Card, etc.) of the proprietor.

- Address Proof (Valid Passport, Utility bill, Property tax bill, etc.) of the proprietor.

- Registration Certificate issued by the Registrar of LLP (in the case of a registered concern).

- Certificate/license issued by the Municipal authorities under the Shop & Establishment Act.

- Sales and income tax returns in the name of the sole proprietor.

- CST/ VAT certificate

- Certificate/ registration document issued by the Sales Tax/ Service Tax/ Professional Tax authorities

Partnership Firms

- Registration certificate

- Partnership deed

- Beneficial owners list holding more than 15% in the firm.

- Address Proof & ID Proof

- Power of Attorney (POA)

Private/Public Limited Company

- Beneficial owners list holding 25% share of capital.

- Address Proof & ID Proof

- Certificate of incorporation

- Memorandum & Articles of Association

- Power of Attorney (POA)

Trust, Society, Unincorporated Association & Club

- Certificate of registration

- Trust Deed

- Address Proof & ID Proof (trustees, executors, administrators, etc.)

- Power of Attorney (POA)

- Beneficial owners list