Banks are a basic need to manage your finances and to store your hard-earned money. Nowadays, all the banking system has shifted online and India is one of the countries that use online banking system extensively. Most of the banks in India and elsewhere use online banking and provide banking services online.

Since the Indian diaspora is the largest in the world the banking system in India provides global banking services. You can find Indians in almost every country and therefore, the Indian banking system has to provide global services to NRIs.

The Indian Bank with the largest network of overseas branches is the State Bank of India or SBI. SBI has 52 total foreign branches in every major city where there is a presence of Indian diaspora. The bank provides banking facilities to the NRIs through NRI Account. In this article, we will discuss how to open an NRI Bank account in SBI.

Documents Required for NRI Account at SBI

While applying for an NRI account, arranging the documents is the very first thing that an individual does. The applicant must have certain documents to open a bank account as an NRI. The following are the list of documents required to open a bank account in SBI-

| Identification Documents | If you are an NRI status holder | If you are PIO / OCI status holder |

| Proof of Status | Any one of the following: Valid Visa / Work Permit Any one of the following for NRIs with Seafarer work profile: Valid Job Contract Continuous Discharge Certificate (CDC) Expired contract letter Last payslip evidencing employment with a shipping company | Any one of the following: Valid PIO CardValid OCI Card Relevant pages of Passport of parents or grandparents, establishing their Indian Origin Marriage Certificate establishing spouse’s Indian Origin |

| Proof of Identity | Relevant pages of Passport | |

| Current Address document (Overseas only) NRIs with seafarer work profiles and on the ship, can either give employer’s overseas address or Indian address. | Anyone of the following: Relevant pages of Passport (mentioning overseas address) Self-declaration of address with positive confirmation by submitting a copy of any one of the following: Government-issued National Identity Card at the country of residence driving License issued abroad Utility Bill (Electricity, Telephone, Gas) Original copy of latest overseas bank account or existing NRE / NRO account statement carrying overseas address Employer’s certificate Address proof of the blood relative | |

| Proof of Permanent Address (Overseas / Indian) | Any one of the following: Relevant pages of Passport Driving License Voter Identity Card Aadhaar Letter/Card NREGA Job Card | Relevant pages of Passport |

| Additional proof for applicants who are not visiting SBI Branch for opening the account (Non-face-to-face) | Any one of the following: A cheque is drawn on the overseas Bank account Canceled / Paid Cheque of the overseas Bank account Proof of Income / Pay Slip / Tax return | |

| Additional requirement | 2 Passport size photographs Certified English translated copy of the document wherever it is in a foreign language |

Note- All the documents that you provide must be self-attested and further attestation of any authority is also required from SBI Oversea Branch or Indian Embassy/High Commission.

The Process to Open NRI Account in SBI

The following are different ways you can use to open an NRI account in SBI-

Apply By Visiting the Bank Branch

You can open an NRI bank account by visiting the SBI bank branch. In case you cannot visit the SBI bank branch then you can attest your documents and photocopies by the Indian Embassy, or the Notary. The following are the step by step methods for opening the NRI Account in SBI-

- Ask/Download the account opening form from the SBI branch/website

- Now, you have to fill the form with accurate information

- Along with the form, you have to attach the document mentioned above

- Now, you have to visit the Indian Embassy and get the documents attested by the embassy office. You also have to pay some fees which vary from location to location

- After attested the documents, you have to send the account to the SBI global bank branch via post

- It’ll take 10-15 days for all the documents to be processed and your account to be opened

- SBI will send you a welcome kit via a post on your permanent address that you can use for NRI banking

- The welcome kit contains an ATM card, checkbook, and other online banking details.

Apply Online On SBI Website

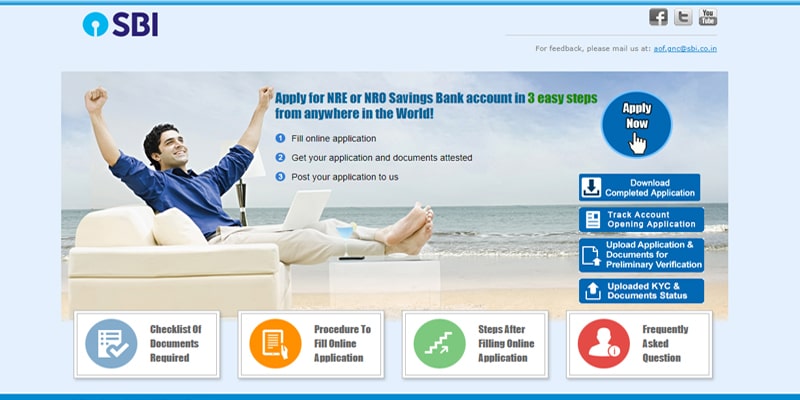

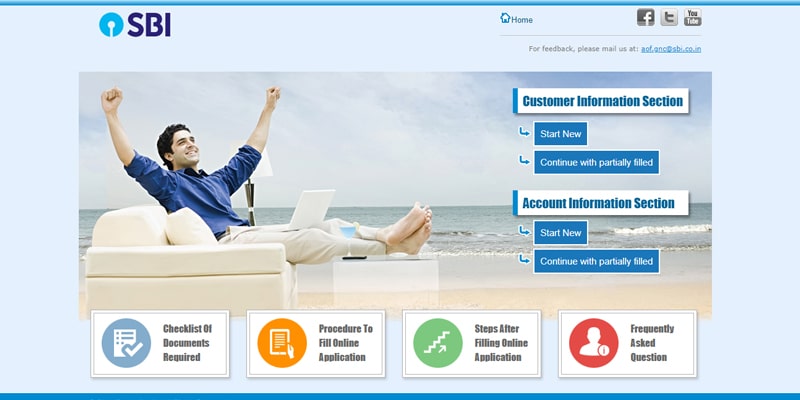

You can follow these steps to apply for an SBI NRI account-

- Visit the official website of the SBI NRI account by following this link- https://oaa.onlinesbi.sbi/oaonri/onlineaccapp.htm

- Now, click on the Apply Now button and you’ll be prompted with two options- Customer Information Section and Account Information Section

- You have to fill both the section correct information by clicking on start now on each of them separately

- After filling the application form, you have to download your online application by clicking on “Download Completed Application” located on the home page using your NARN number and Date of Birth

- Now, affix passport size photograph(s) of sole/first applicant and second applicant (if any) in the ‘Specimen Signature, Photograph & Third Party Attestation’ section on pages 3 and 5 respectively

- You have to send the application form via post to the Indian embassy, overseas bank branch, or Notary. Also, enclose one additional photograph of each applicant in the envelope while sending the account opening application to the Bank

- If you are sending an initial remittance (cheque/demand draft), then please draw it in favor of “State Bank of India A/c [Applicant’s Name]”.

- You have to mention “ONLINE NRI ACCOUNT OPENING APPLICATION [NARN No issued to you]” on the cover of the envelope and post/courier your Account Opening Application along with Identification documents after attestation

- It is advised that before sending any documents, you can verify your account documents list by uploading the documents for preliminary verification. The document uploading section is mentioned on the home page of the website.

SBI NRI Minimum Balance Required

The minimum account balance that the account holder has to maintain is different for different customers depending on the location of the bank branch. The following are the minimum balance required to maintain the SBI NRI account-

| Branches | Average Minimum Balance |

| Metro/ Urban Branches | Rs.3,000/- |

| Semi-Urban Branches | Rs.2,000/- |

| Rural Branches | Rs.1,000/- |

SBI NRI Savings Bank Interest Rate

The following are the interest rates provided by the SBI for NRI accounts-

| Sr No. | Particulars | Rate of Interest |

| 1 | Saving Deposits Balance up to Rs. 1 lakh | 2.70% p.a |

| 2 | Saving Deposits Balance above Rs. 1 lakh | 2.70% p.a on the entire balance |