Financial transactions can be of various kinds and Demand Draft (DD) stands out as one of the oldest and most significant to this day. Cheques, Credit Cards, and Debit cards are other ways of making payments but Demand Draft provides the most secure and seamless transfer of funds.

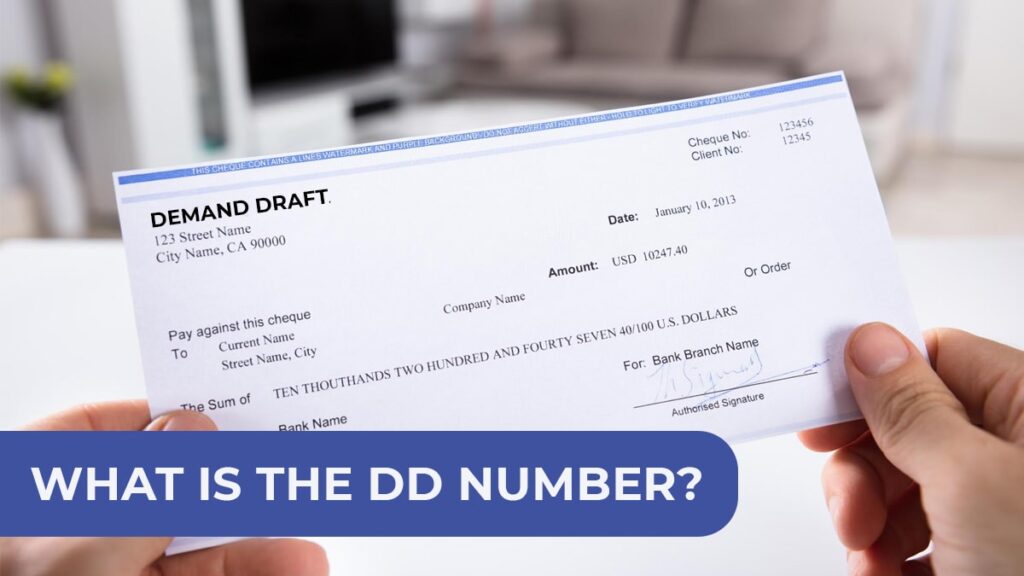

Every DD comes with a unique identification number crucial for tracking and verifying the status of the draft. In this article, we will discuss what the is DD Number, Details to be filled in on DD, Details Mentioned on DD, How to Issue a Demand Draft, and much more.

What is Demand Draft?

A demand Draft is a fund transfer instrument used by a client to issue a fund transfer instruction to the bank that issued the demand draft to transfer the said amount to the receiver.

Demand Draft is only issued by the bank in the name of the receiver and it is non-transferable meaning, the receiver of the DD can cash the DD without requiring any signature from the account holder ensuring security and safety.

DD is majorly being used in banks where there is a large amount of transfer required like buying a house or used for Government process/procedure application filling.

The name of the receiver who will receive the payment is mentioned on the DD and no other person can cash the DD. The receiver of the DD is called Payee and the sender is called Payer.

Details To be filled on Demand Draft (DD)

The following are the details to be filled on a Demand Draft form-

- Name and Address of the drawer (your name)

- Name of the drawee

- Name and address of the payee

- Name of the city where DD is payable

- Amount payable to the drawee (in words)

- Amount payable to the drawee (in figures)

- Exchange (fee charged by the bank)

- Total amount payable by the drawer to the bank (in figures)

- Signature of the drawer

- Name and Address of the drawer

Details Mentioned on Demand Draft (DD)

The following are the details mentioned in the Demand Draft-

- The branch of the bank issuing the DD

- Details of the Payee

- Date of issue of DD (valid period is three months from this date)

- This amount payable to the drawee in Words

- A unique number is assigned to the DD

- Signatures of the officers of the bank branch issuing DD

How to Issue a Demand Draft?

The following are the steps that you’ll have to follow to get a Demand Draft issued-

- Visit your nearest bank branch and ask the bank representative for the Demand Draft form

- Fill the form with details like name, Address, Name of the drawee, Name, and address of the payee, Name of the city where DD is payable, amount, etc.

- Now, submit the filled DD form to the bank representative along with the mentioned amount either through cash or via bank transfer

- The bank will process your DD request and verify all the details

- After successful verification, the bank will issue the Demand Draft which you can submit to the payee to complete your payment

Documents Required for Issuing Demand Draft

The following are the documents that you are required to show for issuing the Demand Draft-

- PAN Card details (DD Above Rs.50,000/- mandatory)

- Aadhaar card

- Credit card bill, or any other utility bill

- Driving license, or any other ID with your name on it.

Important Points Related to Demand Draft

There are some of the important points related to Demand Draft (DD) which you’ll need to keep in mind-

- For amounts exceeding Rs.50,000/- or more, you’ll have to provide your PAN details to the bank

- For amounts less than Rs.50,000/-, you’ll need to show your ID and address proof to the bank

- It is advisable that before submitting the DD form to the bank, check the details in the form thoroughly and ensure there are no mistakes

- Before leaving the bank ensure that the DD issued by the bank has the correct drawee’s details

- Keep a photocopy or photo of the DD issued by the bank with you before handing it over the the payee, this ensures you have some evidence in case a problem occurs

FAQ

DD Number is a unique number that is assigned to every Demand Draft which is used for identification, tracking, and verification of the status. This number is important for both the payer and payee for tracking the transaction.

Cheques are a payment instrument that is linked to the issuer’s bank account and when the payee cash the cheque then the payee’s account is debited with the money. Demand Draft on the other hand is a prepaid payment instrument that is created for a specific purpose and in the name of the specific person or entity. This makes it a more secure method of transactions, especially when dealing with large sums of money.

Yes, all banks provide you with a Demand Draft service using which you can issue a Demand Draft or DD in the name of the entity or person you want to pay.

The fees associated with the Demand draft depend on various factors and depend from bank to bank. The fee may vary depending on the draft amount, the issuing bank’s policies, and the location of the payee.

The validity of the DD varies from bank to bank and typically around three to six months. After this period, the draft may expire, and the payer may need to request a revalidation.

Yes, in certain circumstances, a Demand Draft can be canceled or reissued. However, the process and feasibility depend on the policies of the issuing bank. Fees may also apply for such requests.

If a Demand Draft is stolen or lost, then the payer has to immediately inform the issuing bank about the lost DD. The bank will then stop the payment of the lost Demand Draft and provide you with a replacement draft after verification.