Unified Payment Interface is the most revolutionary technology that came out of India which makes it easy for people to do transactions.

Whether it’s Rs.1/- payments or Rs.5000/-, you can make payments through the UPI app easily by using your mobile phone.

UPI has also aided the digital infrastructure that has rapidly developed in India. The UPI is such a success that Google pushed for the development of a UPI-like system in the US.

UPI is managed by the NPCI and regulated by the RBI for the rightful functioning of the system. Recently, RBI announced that UPI Payments can also be made using the UPI system.

This will be revolutionary news as the number of credit card users in India is 62 million and this number is only going to increase.

When credit cards will be enabled on the UPI network the ease of payments will further increase and benefit the people using the app.

For using the credit card on your BHIM UPI app, you’ll have to add the card to your BHIM UPI app. In this article, we will discuss how to make BHIM UPI Payments using a credit card, the dos, and don’ts of the BHIM UPI App, etc.

How to Make BHIM UPI Payments using a Credit Card?

You can follow these steps to make UPI Payments using a credit card on your BHIM UPI App-

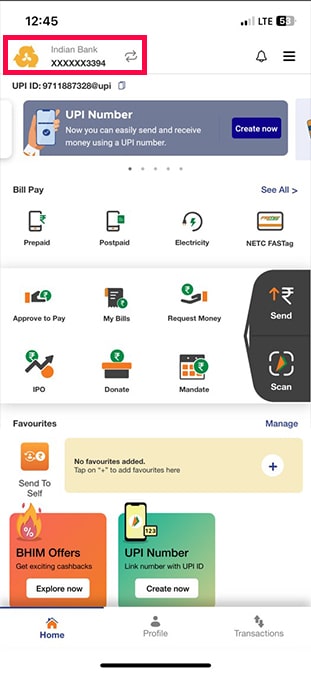

- Open the BHIM UPI app and get yourself logged in to your account

- Now, on the home screen, you’ll find the account summary section on the top left corner of your account with your bank logo

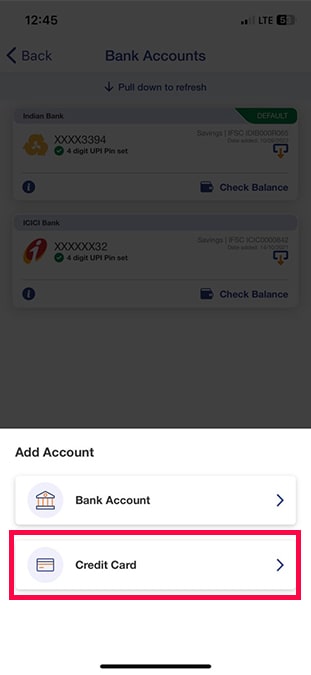

- Click on that and you’ll e redirected to a new page where you’ll have to click on the “+” button

- Now, select a Credit card from the given option followed by selecting the credit card issuer bank

- Now, the app would want to send an SMS to the credit card bank server to initiate the activation process

- After initiating the activation process, you’ll have to enter the credit card details like account number, expiry code, CVV, etc.

- After entering these details, click on the next button followed by creating your login ID using which you can login to your account easily

- After creating your 4-digit login passcode, you’ll be able to make UPI Payments using a credit card as well.

Dos of BHIM UPI App

The following are the Dos of the BHIM UPI App-

- Keep your login password very safe and do not share it with anyone

- Make sure the login password that you’ve created is an unpredictable number that only you can remember

- In case of any wrong transaction or fraud transaction, you can raise disputes and resolve the issue

- Before confirming any payment request make sure to check the requestee details to keep your transactions safe

Don’t of BHIM UPI App

The following are the Don’t of the BHIM UPI App-

- Do not scan the wrong QR codes when you have to receive payment from someone else. To receive payments, you can either use the request payments option or simply provide your QR code

- Do not use public wifi or data to make payments as it can lead to an unsecured network making your device vulnerable to any cyber attacks

FAQ

Yes, you can add your credit card to your UPI app. RBI has recently announced the addition of credit cards to the UPI App.

You cannot recover your UPI PIN back however, you can reset a new UPI PIN for your app. You can click on the forgot UPI PIN on the login page and follow the instructions provided by the app to reset your UPI Passwords.

Yes, there is a payment limit for the UPI Payments of Rs.100000/- per day limit or 10 transactions in a day limit. Also, you cannot request more than Rs.3000/- using the UPI App.

No, there are no charges for the UPI payments on the customers.