Many times it becomes difficult for the bank account holder to find the bank account balance because there is a bank holiday and you cannot visit the branch or the ATM is far from your home. IndusInd Bank introduced the missed call balance inquiry service for the account holder that enables them to find the bank account balance by giving a missed call from the registered mobile number.

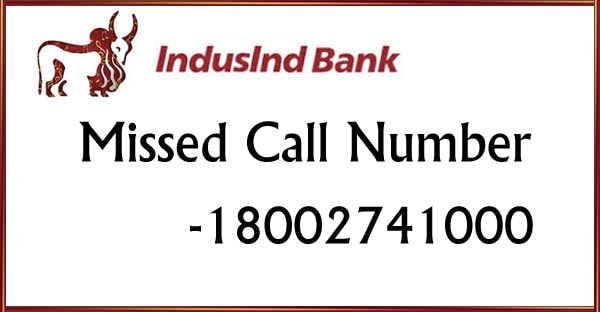

IndusInd Bank Balance Inquiry Number

The IndusInd Bank Missed Call Number is 18002741000. After giving a missed call on the number you will receive an SMS regarding the bank account balance.

About IndusInd Bank

IndusInd Bank is a private sector bank owned by the Hinduja Groups founded by S.P. Hinduja in the year 1994. The IndusInd bank is often referred to as a new generation bank that offers all the advanced features to their customers. As of 2019, the bank has 1,325 branches all over the country. Apart from the missed call number IndusInd Bank also offers the following ways to find the bank account balance-

- IndusInd Bank SMS

- IndusInd Bank Mobile Banking

- IndusInd Bank Net Banking

- IndusInd Bank USSD

- IndusInd Bank ATM

IndusInd Bank SMS Balance Check Number

IndusInd Bank also offers the SMS Banking option to find the bank account balance. The account holder needs to send the SMS in a pre-defined Syntax. The number for sending the SMS is 9212299955. You can use the following syntax to find the bank account balance-

| Service | SMS format |

|---|---|

| Check Account Balance | BAL |

| Check Last 3 transactions | MINI |

| Recharge Own-Mobile Number* | MYREC<space>RECHARGE AMOUNT<space>Last 4 digits of debit card |

| Recharge other mobile number | MOB<space>10-DIGIT MOBILE NO<space>TELECOM OPERATOR NAME<space>RECHARGE AMT<space>Last 4 digits of debit card |

| Recharge DTH connection | DTH<space>SUBSCRIBER ID<space>OPERATOR NAME<space>RECHARGE AMT<space> Last 4 digits of debit card |

| Generate MMID | GETMMID |

IndusInd Bank Balance Check by Mobile Banking

The IndusInd bank offers the mobile banking facility that enables the account holder to use the banking service 24X7 and 365 days without any need to visit the bank branch. The Mobile app also offers the customer to find the bank account balance. The download link for the mobile app download is given below-

IndusInd Bank Balance Check by Net Banking

Net banking is the facility that enables the user to use the banking services. You can use fund transfer to balance check by using the net banking within the comfort of your home. To avail this service you need to have login details of a bank account which will be provided by the branch of the bank. After receiving the login details of the bank you can use the IndusInd Bank Net Banking.

IndusInd Bank Balance Check by USSD

USSD Stands for Unstructured Supplementary Service Data that enables the user to use the mobile phone as a banking tool. Unlike other mobile banking methods, this does not require your mobile phone to be a Smartphone. You can use a Feature phone to use the service. These codes are also referred to as Quick codes or Feature Codes. You can use the service by dialing the number and pressing the call button, after dialing the number a menu will appear with the different option to choose from. The following are the codes that can be used from your Registered Mobile number-

| Transaction Name | Short code (Registered Users) | Short code (New Users) |

|---|---|---|

| Fund Transfer | *99*1# | *99*69*1# |

| Request Money | *99*2# | *99*69*2# |

| Check Balance | *99*3# | *99*69*3# |

| My Profile | *99*4# | *99*69*4# |

| View Pending collect requests | *99*5# | *99*69*5# |

| Transaction history | *99*6# | *99*69*6# |

| Set UPI PIN | *99*7# | *99*69*7# |

IndusInd Bank Balance Check by ATM

IndusInd Bank ATM Card can be used to find the bank balance of the account holder. You can use the following steps to find the bank account balance-

- Insert your ATM Card in the ATM Machine

- Enter the PIN in the ATM Machine

- Now select the Balance inquiry option

Minimum Maintenance Balance Required for IndusInd Bank

Every Bank has a minimum bank balance requirement that has to be maintained by the bank account holder. The following are the minimum balance requirement for the IndusInd bank-

| Savings Account | Balance Required |

|---|---|

| Indus Maxima Savings Account | Average Quarterly Balance – INR 25,000 |

| Indus Privilege Savings Account |

MAB of Rs. 10, 000

in A category branches MAB of Rs. 10, 000 in B category branches MAB of Rs. 5,000 in C category branches |

| Indus Privilege Active | This is a transaction based account with no requirement of monthly average balance. |

| Indus Diva Savings Account | Average Quarterly Balance of Rs 25,000 or Fixed Deposit of Rs 5,00,000 |

| Indus Senior Savings Account |

Indus Senior

(Privilege) Average Monthly Balance of Rs. 10,000 or Fixed Deposit of Rs. 2,50,000 Indus Senior (Maxima) Average Quarterly Balance of Rs 25,000 or Fixed Deposit of Rs. 5,00,000 |

| Indus Young Saver | Monthly balance requirement: 5000, waived off if a parent privilege account is linked, or on a Recurring Deposit of 2,500 or more per month |

| Indus Classic Savings Account |

A Category Branches

– Rs. 10,000 B Category Branches – Rs. 10,000 C Category Branches – Rs. 2,500 Rural/C1 Category Branches – Rs. 1,500 |

| Indus Easy Savings Account | Zero minimum balance |

If the account holder fails to maintain the minimum bank balance then the account will be subject to the fine/charges. The charges for the Non-Maintenance are as follows-

| Account Type | Charges |

|---|---|

| Indus Classic A & B | If MAB in the account is between Rs.5,000 to Rs.10,000/-Rs 250/- per month If MAB is less than Rs.5,000/- Rs 350/- per month |

| Indus Classic C | If MAB in the account is between Rs.2,500 to Rs.1,250/-, Rs 250/- per month If MAB is less than Rs.1,250/-, Rs 350/- per month |

| Indus Classic Rural/C1 | If MAB in the account is between Rs.1,500 to Rs.750/-, Rs 250/- per monthIf MAB is less than Rs.750/-, Rs 350/- per month |

| Indus Privilege A&B | If MAB in the account is between Rs.5,000 to Rs.10,000/-, Rs 250/- per monthIf MAB is less than Rs.5,000/-, Rs 350/- per month |

| Indus Privilege C &Rural/C1 | If MAB in the account is between Rs.5,000 to Rs.2,500/-, Rs 250/- per monthIf MAB is less than Rs.2,500/-, Rs 350/- per month |

| 3 in 1 Privilege account / 1 in 3 Privilege account | If MAB in the account is between Rs.10,000 to Rs.5,000/-, Rs 250/- per month If MAB is less than Rs.5,000/-, Rs 350/- per month |

No charges will be charged if the account holder

Indus Classic A & B

- Category A-Fixed Deposit of amount Rs.50,000/- and above can be maintained to avoid non maintenance charges

- Category B- Fixed Deposit of amount Rs.35,000/- and above can be maintained to avoid non maintenance charge

Indus Classic C

- Fixed Deposit of amount Rs.25,000/- and above can be maintained to avoid non-maintenance charges