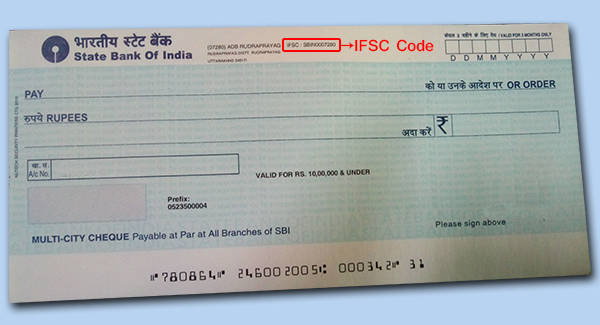

Post merger of the SBI with its associate banks, the scenario is full of confusion and chaos pertaining to the usage of the IFSC codes of the erstwhile associate banks. The IFSC code change was expected to be announced in the second quarter for the year 2017 to 2018. But the SBT customers are now being advised to use the new IFSC codes and MICR codes that were reflected in the new pass books and cheque books issued to the customers. Although the users were given a deadline until June 30th to start using the new IFSC codes, the bank personnel are encouraging the users to use new codes as soon as possible. Usage of old codes may result in rejected transactions due to invalid IFSC codes. This has fanned rumors that every other associate bank IFSC code will be changed subsequently. Once the data merger of the SBI associate banks is completed the SBI will announce the changed IFSC codes for all the associate banks.

Net banking and the Merger Effect: The SBI has maintained that the net banking modes will not have major changes except the URL for the website. All associate bank users will now have to access the net banking from the onlinesbi.com URL as opposed to the associate bank URL. There is no change in the username and password of the net banking users. Both the corporate banking and personal banking pages now reflect the merged user data making it easier for the net banking user to perform online transactions like earlier. There is no need to register the mobile number again nor the email ID registered earlier with the associate bank. The data merger work will take care of it and move the data into the appropriate data field. One should look into the right tab to find all the saved settings, registered numbers, billers, and beneficiaries. If a customer owns two accounts in the SBI and its associate bank, the data merger will bring the accounts under a single customer information file, but not merge them until the customer requests for the same.

Funds Transfer: The regulator of the account holder will find no difference in the reports. The pre-paid cards issued to the employees by the corporate account holders will continue to work like earlier. Request for DD by a corporate net-banking client is disabled until further notice. But an online request for issue of the draft can be made with the SBI. The transfer of funds from a corporate net banking customer to the erstwhile associate bank customer must ch/*oose the other bank beneficiaries to continue with the fund transfer.

Confusion in Addition of Third party beneficiary: There is more confusion when it comes to finding or adding the beneficiaries who own an account in the erstwhile associate bank. If the user had added the beneficiary under State Bank Group Transfer, the data merger will move the beneficiary data under the Intra Bank tab. When paying at a merchant outlet or the electronic website, a user may have to choose the name of the bank to be SBI as and when needed. If one requires adding a beneficiary who owned a prior account with the associate SBI bank, one must use the ”within SBI” link, ”Intra-bank” option.

To execute personal internet fund transfer between erstwhile associate banks a third party transfer under the Intra Bank tab is the right choice. There is confusion regarding the transaction modes and IFSC codes to be given for executing the intra-bank NEFT transfers. A net banking user may have to check with the bank for change in IFSC codes before trying to execute such transactions. The confusion is deeper here because not all the associate banks are intimated with the new IFSC codes to be disclosed to the erstwhile associate bank customers.

Deposit schemes as per SBI guideline: Any form of deposits offered at the erstwhile associate banks will be modified as per the SBI schemes. A user cannot expect the same rates to be applicable for a new deposit scheme being opened with the SBI.

Loan application submitted to the erstwhile associate bank: The applicant may have to submit crucial documents to the SBI again.

The SBI has announced renewed charges for IMPS, NEFT/RGTS services.

Fund Transfer modes attract a revised service charge: From June 1st revised charges for IMPS, NEFT charges are applicable for all the SBI customers. Use of SBI Mobile Buddy attracts a charge of Rs. 25 per transaction. The ATM withdrawals are also charged after the four free transactions for the Basic savings bank account customers. In addition to the service charges, a service tax is also levied for all ATM withdrawals, IMPS, etc. It is prudent that a user checks the revised rates before using the apps like SBI Mobile Buddy.