The rapid spread of Covid 19 is making people aware of the need of social distancing. This is giving rise to healthy online transactions where more and more people are looking for online shopping options to fulfil their daily requirements. To help people in their endeavours and make claim facilities safe, fast and secure, the Life Insurance Corporation of India (LIC) has come-out with the facility of online claims. With the help of online facility, a person can easily register for death claim, request for maturity and survival dues, engage in annuity registration and existence certificate submission, and fruitfully complete policy revival (if it has gone into a lapse state) along with NEFT mandates.

Skip Making a Physical Visit to the LIC Branch

One big advantage of this portal is that it allows you to submit supporting documents at the online platform. This saves you from making a physical visit to the LIC branch to submit the said documents physically. This facility comes in the wake of the government-owned insurer directive that launched an e-mail reminder to all its eligible customers to file for claim settlements by the date of 30 June.

Maturity Claim

After the maturity of the investment account, the policyholder will get intimation from the LIC regarding the maturity of the account before 2-3 months of the maturity date. You’ll also get a discharge voucher which you and a witness have to sign and sent to the LIC along with the original policy document. The Maturity will be settled on the date of the maturity after the legal formalities have been completed.

Online Claims

The claims that can be made online are maturity claims, survival benefit claims, and death claims. As stated earlier, you can also make an online claims for the revival of policies and annuity plan procedures such as existence certificates. Lastly, you can easily engage in Aadhaar seeding through this site. Listed below are the steps to make LIC Claims Online

Register as a Site User

The first step to use the online e-services portal, is to register as a user of the site. Prior to registration, you must keep certain things handy by your side. They are:

- Policy numbers.

- Instalment premiums under these policies (excluding service tax/ GST).

- Scanned copy of either passport or the PAN card having a file size lesser than or equal to 100 KB. The preferred formats for the scanned images are .jpg or .jpeg format. However, you can also upload images in .bmp, .png, .gif and .tiff formats.

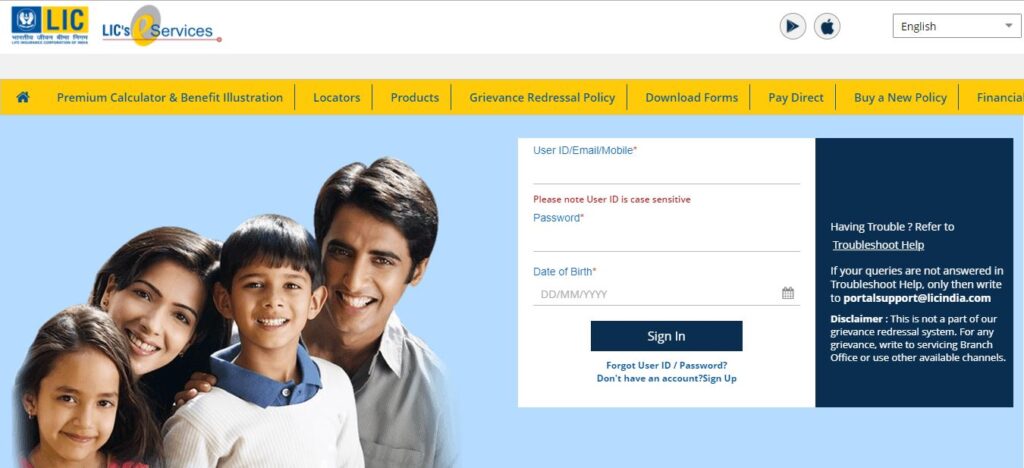

Process to register on LIC portal

- Go to the official Life Insurance of India site. https://licindia.in/

- Go to the option “Online Services” and choose “Customer Portal”.

- A new page would open up. Click on the option “New user”.

- Choose your own user-ID and password and fill in the essential information.

- If you want to avail e-Services, then hit the button “e-Services”.

- Log in into the Customer Portal again with the user-ID created by you and register all your policies to benefit from the e-service facility by filling up the provided form.

- Take out a print of the form. Sign at the requisite place and upload the scanned copy of the form.

- Also upload the scanned copy of your passport, Aadhaar card, or your PAN card number.

- The LIC would do a KYC verification based on the information provided by you. Once satisfied, it will send an acknowledgement through e-mail and SMS.

- Hit the “Submit” button.

- On the landing page, you must select your choice of user ID and password and submit.

- Use this user ID and password to login into the site and click on the button ‘Basic Services’ -> “Add Policy”.

- In a similar manner, enrol all the other policies.

Customers can always get in touch with LIC customer care in case of any issue.

Registration Process for Premier Services

- Login into the official LIC website www.licindia.in with the help of your newly created user ID and password.

- For the Premier Services, fill in the associated registration form.

- After successful registration, various basic details such as policy numbers, date-of-birth and mobile number gets automatically filled up into the registration form. However, it must be noted that the life insurance for a spouse would require a separate registration process initiated by her/him.

- Fill in the appropriate passport of PAN card number.

- Click on Print/Save form option and get a print of the registration form.

- Carefully check all the filled-in details of the registration form to see that all the information entered is correct. Once satisfied you need to sign it.

- Get a picture of the scanned copy of the signed form and upload it along with a scanned copy of your chosen KYC document (PAN card or Passport) at the allotted spaces. Remember that the file size of the scanned images must be under or equal to 100 KB and available in the format .bmp, .png, .jpg, .jpeg, .gif or .tiff.

- Submit the request.

- You will receive an email and an SMS acknowledging the acceptance of the registration form at the email address and phone number that you have registered with LIC.

- Within three-days’ time of registration, your request would be dispatched to the LIC’s customer zone official. Here your claim would be verified and on founding genuine you will get an acknowledgement e-mail and SMS with the message “Now you are ready to avail our Premier Services”.

- Once registered, you could log in and choose your claim type to make and fill the requisite form.

LIC Death Claim

In the instance of death claim, you would have to submit documents such as:

- Claim Form ‘A’ in Form No. 3783. (Print, sign and scan)

- Death certificate of the deceased policy holder

- LIC Policy document (original)

- Deed of assignment (if any)