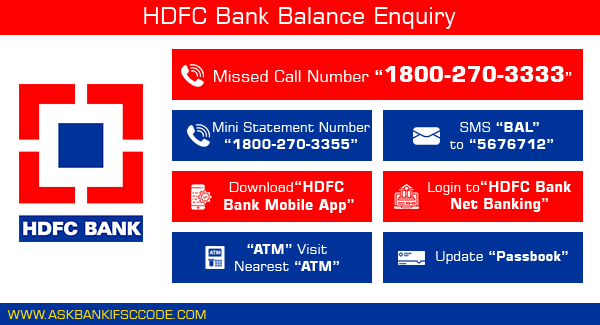

HDFC Bank provides various missed call numbers to check account balance, mini statements, checkbook requests, account statements, and more. To get your account’s latest balance or any other service, you just need to give a missed call to missed call number and after two rings the call will be automatically disconnected and an SMS with request status will be received. Below are the various methods thru which you can check HDFC bank account balance.

HDFC Bank Balance Inquiry Number

HDFC Bank missed call banking can be used by giving a missed call to the HDFC Bank missed call number and receiving an SMS Containing the bank account details. To get the updated account balance, just give a missed call at 1800-270-3333.

There are other missed call numbers that could be used to make other requests. Following is the list of missed call banking services provided by the HDFC Bank:

| Phone Number | Services |

|---|---|

| 1800 270 3355 | HDFC Bank Mini Statement Number |

| 1800 270 3366 | Request For Cheque Book |

| 1800 270 3377 | Account Statement |

| 1800 270 3344 | Mobile Banking App |

| 1800 270 3388 | Request For Email Account Statement |

How to Register for Mobile Banking with HDFC Bank?

In case you receive an SMS saying “You are not registered for SMS Banking…”, that means your mobile number is not registered for missed call banking and you have to register your mobile number with the bank first. You can use the following methods to register the number with the HDFC Bank-

Register using the HDFC SMS Banking via HDFC Bank SMS Balance Check Number

You can use the SMS format in the following format to register for the Mobile and SMS banking services-

REGISTER <Customer ID> <Last 5 Digits of A/c No.> to 5676712

Register using the Net Banking

Net banking can be used to register for Mobile and SMS banking services. Follow these steps to register for SMS and Mobile banking using net banking-

- Login to the HDFC Bank Net Banking using the Customer ID and Password

- Navigate to the SMS Banking registration

- A form will appear, fill it with details and SMS will be provided that will confirm the SMS Banking

Register using the ATM Card

You can use the HDFC Bank ATM Card to find the register for the Mobile and SM Banking. Follow these steps to register for the services-

- Insert the ATM card in the machine

- Select the More option tab

- Now select the option that says ”Register for HDFC Bank Mobile Services”

- Insert the PIN followed by an OTP for confirmation

Register using the Application form

You can visit the bank branch and fill the Application form for SMS and mobile banking services. HDFC bank branch staff will provide you with the information on the registration. It is advisable to take the HDFC bank passbook for account details that will be required to fill on the application form.

HDFC Bank SMS Banking va HDFC SMS Balance Check Number

HDFC Bank SMS Banking can be used by sending an SMS to 5676712 in pre-defined syntax keywords that tell the bank about the information you need. The syntax to send the bank are as follows-

| SMS Syntax | Transaction |

|---|---|

| bal | Balance Enquiry |

| txn | HDFC Bank Mini Statement Number |

| cst <6 digit cheque no> | Cheque Status Enquiry |

| chq | Cheque Book Request |

| stp <6 digit cheque no> | Stop Cheque |

| stm | Request for an Account Statement |

| bil | Bill Details |

| fdq | Fixed Deposit Enquiry |

| new <14 digit account no> | Change of Primary Account |

| ipin | Internet Banking password (IPIN) regeneration |

| PAN <PAN number> <Cust Id> | PAN number updation |

| KYC <dd/mm/yy> | Re-KYC compliance is done for low risk individual customers |

| REPIN <last 4 digits of Debit Card> | Debit Card Green Pin generation through SMS Banking |

| MYHDFC | All the pre-approved offers in your cust id can be had at a glance |

| help | List of keywords |

HDFC Bank Mobile Banking

HDFC Bank offers an app that can be used to do all the banking operations with the use of your Smartphone. The app can be used 24X7 and 365 days which makes it the best banking tool for banking purposes. You can download them from the Google Play store or Apple App store.

HDFC Bank Net Banking

Net Banking is one of the best banking features that have been provided by any bank. Net Banking provides access to the banking services 24X7 and 365 days just like the mobile Banking but to use this service you only need the internet connection and a browser installed in your laptop or PC. You can use the service by logging in to the HDFC Net Banking facility.

HDFC Bank ATM

HDFC Bank ATM Card can be used to find the bank balance of your bank account. You can use any bank ATM Machine to find the bank balance and it is free of cost. You can use the following methods to find the bank account balance-

- Insert your bank ATM Card in the ATM Machine

- Enter your PIN in the Machine

- Select the Balance inquiry option

HDFC Bank IVR Inquiry

IVR stands for Interactive Voice Response which provides a balance check facility to the HDFC Bank customer. It is a customer care service that uses a computer-generated voice that instructs you for finding various services. To find the bank balance of the account you have to call the HDFC bank IVR Customer care number- 022-61606161. You have to choose the language by pressing the instructed number followed by the service you want.

HDFC Bank Passbook

Passbook is the easiest method for keeping the track of the bank balance and the transactions that are initiated from the account. You should update the passbook regularly in order to keep the track of your finance. A regular visit to the bank branch is necessary for updating the bank passbook.

About HDFC Bank

HDFC Bank is the largest Private sector bank in India with 5,854 bank branches all over the country. The Bank started its operation in the year 1994 and after that, the bank raised up to become India’s largest private sector bank. Missed call balance check facility is the best facility is the most convenient way to find the bank account balance. Apart from the missed call number the bank also provides other methods that can be used to find the bank account balance and those are as follows-

- HDFC Bank SMS Banking

- HDFC Bank Mobile Banking

- HDFC Bank Net Banking

- HDFC Bank ATM

- HDFC Bank IVR Inquiry

- HDFC Bank Passbook

Minimum Maintenance Balance Required For HDFC Bank

Every bank has a minimum balance required to maintain by the account holder. The minimum Maintenance balances for HDFC account holder are as follows-

| Savings Account | Minimum Balance Required |

|---|---|

| SavingsMax Account | INR 25,000 |

| Regular Savings Account | Rs. 10,000 (urban branches) Rs. 5,000 (semi-urban branches) Rs.2,500 (Rural Branches) |

| Women’s Savings Account | Rs. 10,000 (Urban branches), Rs. 5,000 (Semi Urban branches) |

| Kids Advantage Account | INR 5,000 |

| Senior Citizens Account | INR 5,000 |

| Family Savings Group Account | INR 40,000 |

| Basic Savings Bank Deposit Account | Not Required |

| Institutional Savings Account | Not Required |

| BSBDA Small Account | Not Required |

If the account holder fails to maintain the maintenance balance then the account will be charged with the fine. The charges for non-maintenance for the account balance are as follows-

| Balance Non-Maintenance Charges* | ||

|---|---|---|

| Average Monthly Balance Slabs (in Rs.) | Metro & Urban | Semi Urban |

| Average Monthly Balance Requirement -Rs 10,000/- | Average Monthly Balance Requirement –Rs. 5,000/- | |

| >=7,500 to < 10,000 | Rs. 150/- | NA |

| >=5,000 to < 7,500 | Rs. 300/- | NA |

| >=2,500 to < 5,000 | Rs. 450/- | Rs. 150/- |

| 0 to < 2,500 | Rs. 600/- | Rs. 300/- |

| Average Quarterly Balance Slabs (in Rs.) | Balance Non-Maintenance Charges* (per quarter) – Rural Branches |

|---|---|

| >=1000 < 2,500 | Rs. 270/- |

| 0 – <1000 | Rs. 450/- |