The cheque is a banking instrument that orders a bank to pay a specific amount of money as mentioned in the cheque to the person for which the cheque has been issued. The person writing the cheque is known as drawer and has a bank account from where the money is debited to pay to the person, the person who is receiving the money is known as payee and the mode of payment can be cash as well as money deposit to the payee bank account. It is the most popular way of the transaction as it reduces the effort of carrying a lot of cash for a huge amount of transaction.

Types of Cheque

There are 14 types of check that can be issued for different purposes and for different uses of the drawer. The types of the cheque are as follows-

Order Cheque

When the word “or Bearer” is omitted from the cheque or the word “order” is written on the cheque then the cheque is called an order cheque. A payee can transfer this check to another person by writing his name behind the cheque and this cheque can be withdrawn by the other person by signing it.

Bearer Cheque

As the name suggests bearer cheque, the cheque that can be withdrawn by the bearer who so ever he is called bearer cheque. This cheque is risky because when the cheque is lost then the finder of the cheque can withdraw the money in simple words the money is paid to the person who is in possession of the cheque.

Blank Cheque

The blank cheque is a cheque that is issued to the payee without filling any amount in the cheque. This type of cheque is issued to the payee who is trustworthy. The amount can be filled by the payee as per his desire.

Counter Cheque

The counter cheque is a cheque that is issued by the bank without specifying any information related to your account. The drawer has to fill all the information like the value of the cheque, the date, and their signature but also had to designate the bank from where the transaction is processing. The only requirement of the cheque is to have a MICR Code encoded in the cheque for the clearinghouse to properly handle the cheque.

Stale Cheque

A cheque that is presented to the bank after a certain period of time like more than six months then the cheque is stated as a stale cheque. The validity of the cheque is not specified as per the Banking Regulation Act. However, few banks mention the expiry of the cheque in the cheque itself.

Mutilated Cheque

The cheque which is damaged like is torn into pieces then such cheque is called mutilated cheque. This type of cheque is not accepted by the bank. However, if only the corner of the cheque is torn and the MICR is intact then such cheque may be accepted by the bank.

Post Dated Cheque

A cheque that is issued by the drawer to the payee for future i.e. the date on the cheque is prior to the date of the issue of the cheque then such cheque is called post-dated cheque.

Open Cheque

The open cheque is a cheque that is payable across all the bank counter. This type of cheque is also called uncrossed cheque. An open cheque can be a bearer cheque or order cheque.

Crossed Cheque

A cross across the face of the check is identified as a crossed cheque. The cheque contains a parallel line in the face of the cheque. This cheque adds a protection of the money that has to be paid. There are two types of the crossed cheque-

- Simply crossed cheque- only parallel line is drawn and can be withdrawn in any bank.

- Special crossed cheque- along with the parallel lines the name of the bank from where the cheque can be withdrawn is mentioned in this cheque.

Gift Cheque

Gift cheque is a cheque for gifting purposes. This has a personalized touch and feels to it and this cheque can be purchased in unlimited number with paying a small charge.

Self Cheque

A self-check is issued to yourself meaning the cheque is issued to self in order to withdraw the money for self-use. Here, the drawer and payee both are the same people that is you. This cheque can only be accepted to the bank the cheque belongs to any other bank will not cash such cheques. This is a method of withdrawing money from the bank apart from ATM and other methods.

Banker’s Cheque

A banker’s cheque is issued by the bank on behalf of the customer. This cheque is guaranteed by the bank and the fund mentioned in the cheque is banks own fund. The money from the account is immediately withdrawn after applying for the cheque unlike other types of a cheque which only cashed after the acceptance of the cheque form the bank.

Outstanding Cheque

An outstanding cheque is a payment that has been recorded by the issuing entity, but which has not yet cleared its bank account as a deduction from its balance.

Parts of the cheque

How to write a Cheque?

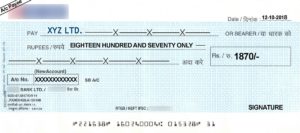

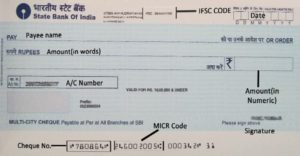

The cheque has five areas which have to be filled by the drawer when writing a cheque those are-

- Date

- Name

- Amount (in words)

- Amount (in numeric)

- Signature

There are some very important guidelines that have to be followed in order to write a cheque so that the cheque doesn’t get bounced-

- The cheque should be in good condition i.e. it should not be torn.

- No overwriting should be done.

- Don’t write on MICR code.

- Do not leave space after the name and also for the amount in words.

FAQ’s

Truncation of the cheque is generally referred to as the transfer of the physical paper cheque into the electronic cheques for further process.

Bearer cheque means the cheque that is paid over the counter to whoever is holding it.

Order cheque is a cheque that is payable only to the person who has his name on it.

Draw two parallel lines across the cheque and write cancel cheque between them. This cheque doesn’t require a signature.

The Lok Sabha passed the Negotiation instrument amendment bill in which a new section was added in 143A Empower the court to provide 20% internship of the impugned cheque to the drawer, such a grant was not mentioned earlier.

Yes, Cheque can be stopped before it is cleared.

The IFSC Code of your branch is mentioned in the cheque where the bank name and other details are mentioned. For example- To find the IFSC Code of SBI Bank is located in the upper-middle section of the cheque.