Sukanya Smariddhi Yojana Account can help the parents to save funds for the future requirement for their daughter. A requirement like Educations and Marriage of the girl can be funded with the use of this account. This account was specially designed to accommodate these requirements for the girl child. The interest earned on this account is high as compared to the other bank account which can be checked by using Sukaya Samriddhi Yojana Calculator.

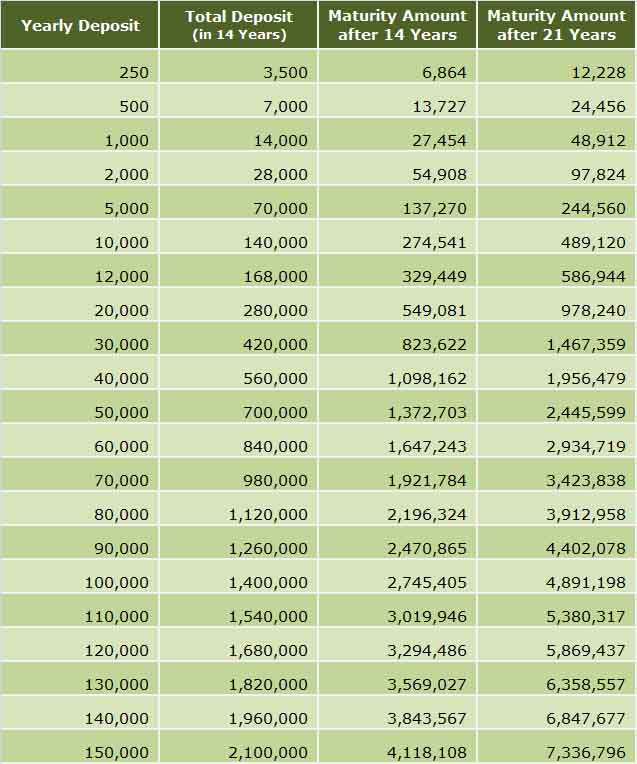

Following Sukanya Samriddhi Yojana Chart shows the yearly deposit, total deposit, maturity amount after 14 years and 21 years. The calculation is done assuming the interest rate remains 8.6 every year, although it changes.

Sukanya Samriddhi Yojana Chart Explained

Sukanya Samriddhi Yojana Chart explains what will be the maturity amount for the deposits you had made to the account. Sukanya Smariddhi Yojana Account has a minimum deposit amount of Rs.250/- and a maximum cap of Rs.1,50,000/-. This chart explains what will be the amount in the account after the respective maturity period.

Let’s take an example to understand the Sukanya Samriddhi Account better although here calculation is accurate, it must be noted that the interest rate changes every year and here we have assumed it as constant, therefore, the calculation might be different than the real maturity amount.

Let’s assume :

- Interest rate remains 8.6 during the period, as it was in 2016-17.

- No withdrawal is made in these 21 years.

- The yearly contribution of Rs. 10,000/ is made on time with a fixed amount of money every year.

Result:

In 14 years you will make a total investment of Rs. 1,40,000/. Maturity amount after 14 years will be Rs. 2,74,541/. After 14 years, you do not have to pay annual instalment but still enjoy interest earning on the total amount. After 21 years you will get a maturity amount of Rs 4,89,120/. You can refer the Sukanya Samriddhi Yojana chart above for returns on a different amount.

If you have not found the amount you wanted to calculation on or want to change interest rates in the above-given Sukanya Samriddhi Yojana Chart , you can download Sukanya Samriddhi Yojana excel calculator.

What is Sukanya Smariddhi Yojana?

Modi Sarkar brings a lot of smiles to the unprivileged people, people who are very poor. Sukanya Samriddhi Account scheme is for every citizen of India who is proud parents of a daughter. From a poor to a middle-class man Sukanya Samriddhi Account scheme is for every class and section of the society. This plan helps in bringing down the deposit rate that will make a huge impact on the unprivileged people. Union Minister Arun Jaitley, in his 2018-19 budget said that the Sukanya Samridhi Yojna has been a great success.

Sukanya Samriddhi Yojna is an initiative of Indian Government especially designed for the parents of the girl child. The scheme was launched by Prime Minister Narendra Modi on 22 January 2015 as a part of theBeti Bachao, Beti Padhao campaign. Female infanticide is a problem our society is facing. This creates a lot of problem in the society we live in. The girl child is often looked as a debt in our society. This creates a gender bias against the daughter of our society. The Government of India felt the need for improving the old and amiss thought of female infanticide. The reason for this sinful action is just one reason that a girl child needs a lot of money for their future needs like-Education, Marriage, and a lot more.

Sukanya Samriddhi Accounts creates an opportunity for the parents of the Girl Child to enjoy the happiness of being the father and mother and at the same time not worrying for their future. Sukanya Samriddhi Accounts scheme provided by many Reserve Bank of India (RBI) authorized banks and offers a lot of benefits. The interest rate of this account is very attractive of 8.5% as of the year 2019. This scheme is also available in Indian post office saving account under the same name as Sukanya Samriddhi Accounts (SSA).

What Sukanya Samriddhi Account Offers?

Modi Government is putting a lot of efforts in bringing benefit to every section of society. Under Beti Bachao, Beti Padhao launched in 2015 gained a lot of appreciation internationally as well as by the vast majority of Indian people. Sukanya Samridhi Yojna is one such scheme under this huge campaign. In this scheme, Modi Sarkar brought down the minimum deposit amount from Rs 1000 to Rs 250. This will bring a lot of saving opportunity for the under privilege too. This is by far the best savings scheme for the poor people.

India is a country of 1.2 billion people among this huge population, there are around 22% of people who are under Below Poverty Line (BPL) around 250 million people as per the government stats in 2012. Currently, there are 1.26 crore people who opened Sukanya Samridi Account (SSA) which is just 0.1% of the population of India which looks small but is yet very impressive. Since India is a country with a huge population even a small number of the population is actually a very huge number. This number is expected to increase by huge numbers as the government has revised the minimum deposit limit to Rs 250 from Rs 1,000

Eligibility for Sukanya Samriddhi Scheme

- A legal Guardian/Natural Guardian can open an account in the name of Girl Child and can open only one account in the name of one girl child and maximum two accounts in the name of two different girl children.

- The account can be opened up to the age of 10 years only from the date of birth and relaxation of 1 more year is there, combined makes a total 11 years of age.

- If minimum Rs 250/- is not deposited in a financial year, the account will become discontinued and can be revived with a penalty of Rs 50/- per year with minimum amount required for a deposit for that year.

- Partial withdrawal, maximum up to 50% of the balance standing at the end of the preceding financial year can be taken after Account holder’s attaining age of 18 years.

- The account can be closed after completion of 21 years.

- The normal Premature closure will be allowed after completion of 18 years /provided that the girl is married.

Benefits of Sukanya Samriddhi Scheme

- It offers attractive interest rates of around 8.5% annually.

- Secures the future of our daughter.

- Provides financial aid to the girl in a time of the need.

- An initiative by the Indian government to promote Beti Bachao, Beti Padhao campaign.

- Tax Redemption is also given under this scheme.

- A minimum amount of Rs. 250 can be deposit in a year as per the new update provided on 22 July 2018.

- Amount to be paid is for an initial 14 years only and on the maturity of the scheme i.e. 21 years. The interest will be paid for the full scheme period.

- After opening the account you will get a passbook to track the amount in the account.

- This account is transferable within any bank offering this account /post office in India.

Interest Rates in Sukanya Samriddhi Account in 2018-19

The interest rate of Sukanya Samriddhi Account tends to change every year. and the interest rate is regulated by the Ministry of Finance from time to time. Followings are year-wise declared interest rates till now:

| Year | Interest Rate |

|---|---|

| 2014-15 | 9.1 |

| 2015-16 | 9.2 |

| 2016-17 | 8.6 |

| 2017-18 | 8.4 |

| 2018-19 | 8.1 |

Documents Required for Sukanya Samriddhi Scheme

- Sukanya Samriddhi Account (SSA) Opening Form.

- Birth certificate of the girl child.

- Identity proof of the depositor.

- Address proof of the depositor.

- Sukanya Samriddhi Account (SSA) Opening Form.

The opening form can be downloaded from the official RBI website or can be collected from the post office/bank.

List of Banks Offering Sukanya Samriddhi Scheme

The Reserve Bank of India has authorized the following banks to open Sukanya Samriddhi Savings accounts (SSA).

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda (BOB)

- Bank of India (BOI)

- Bank of Maharashtra (BOM)

- Canara Bank

- Central Bank of India (CBI)

- Corporation Bank

- Dena Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank (IOB)

- Oriental Bank of Commerce (OBC)

- Punjab & Sind Bank (PSB)

- State Bank of India (SBI)

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

Sukanya Samriddhi account can also be opened at post offices.

Tax Benefit of Sukanya Samriddhi Scheme

In order to encourage investments in Sukanya Samriddhi Scheme comes with tax benefits-

- Investments made in the Sukanya Samriddhi Scheme are eligible for deduction under Section 80C subject to a maximum cap of Rs 1.5 lakhs.

- The interest that accrues against this account which gets compounded annually is also exempt from tax.

- The proceeds received upon maturity/withdrawal are also exempt from income tax.

How to Transfer Sukanya Samriddhi Yojana Account to Other Banks?

The transfer of Sukanya Samriddhi Account is very simple. You can transfer the account from one post office to their post office anywhere in India also you can transfer money from the post office to banks. The procedure for transferring the account is given below-

Step 1- Visit the branch where you have Sukanya Samriddhi Yojana Account with passbook and KYC Documents.

Step 2- Submit the transfer request by mentioning the transfer request with the full address of the bank along with the account passbook.

Step 3- Verification will be done with signature and other documents. The post office will provide you or send the original document or certified copy of the account, account opening Application, specimen signature etc. to the new Bank branch address, along with a cheque or DD for the outstanding balance.

Step 4- Visit the bank where you want to transfer the account with the document received from the post office along with the KYC Document.

Step 5- Fill the new account opening form of Sukanya Samriddhi Account and submit it with all the necessary documentation.

Cost of Transfer of the Account

The transfer of account is free of cost if a change of address is proofed by providing the details of the new address. However, if you are unable to provide the proof then Rs. 100 will be charged by the post office or the bank the account is transferred.

How to Transfer Money in your Sukanya Samriddhi Yojana Account?

Online Fund transfer for Sukanya Samriddhi Account

Online fund transfer for the Sukanya Samriddhi Account is very simple and easy. You can only do online fund transfer if your bank supports the online net banking facility for Sukanya Account if your bank does not support this then you can transfer this as a NEFT transaction. Below are the steps that can be followed in order to transfer funds online-

- Log in to the Internet Banking facility of your bank

- Click on the manage beneficiary

- Select Add option and fill the required data of Beneficiary name as Sukanya Samriddhi Account, Bank or Post office Address, Sukanya account number and set the transfer limit.

- Now fill the Bank IFSC Code of the Beneficiary Bank.

- Now accept the Terms and Condition followed by clicking confirm. A security passcode is sent to your registered mobile number.

- Enter this number and validate the beneficiary. The beneficiary will be added and takes from 30 min to 16 hours.

- Now, Navigate to the transfer fund link from the e-service tab

- Select the transaction type –NEFT, RTGS or IMPS

- Now Select the beneficiary

- Fill the amount and then

- Click on the Standing Instruction option

- Select the Frequency of the payment along with the Payment schedule

- Enter the number of payment and date and Click submit

- Now an OTP will be sent to your Registered Mobile Number fill it in the required field and click on proceed.

- You have successfully transferred the amount to the Sukanya Account on the selected date the amount will be automatically deducted from your account and deposited to your Sukanya Smriddhi account.

Offline Fund transfer for Sukanya Samriddhi Account

Offline Fund transfer requires you to visit the bank branch and fill the form of Demand Draft in favor of the Sukanya Samriddhi account followed by the amount and the Sukanya Samriddhi account number. The change in the amount in your account will be reflected immediately but sometimes may take some time but, it is necessary for you to keep the DD slip with you.

Money Transfer to your Post Office

Online Fund transfer for Sukanya Samriddhi Account

Online Fund transfer for Sukanya Samriddhi account is not available at this moment. However, you can use India Post Payment Bank Net Banking facility for the online payment of the bank. It is similar to the NEFT Transaction and you can follow the above steps to do your online payment.

Offline Fund transfer for Sukanya Samriddhi Account

Post office offline fund transfer is easy and requires you to visit the post office branch and fill the deposit form in favor of Sukanya Samriddhi Account and mentioning the Account number of the Account followed by the amount. You can expect the update of the funds in your account immediately sometimes it may take a while. You can track the transaction by updating the passbook at the time of transfer.

How to Check Sukanya Samriddhi Account Balance?

Sukanya Samriddhi Yojana Account Balance can be checked both online as well as offline. For offline you need to visit the bank/ Post office branch and update your bank passbook. For the online method, you can follow the following steps-

- Get the online login details of the Sukanya Account form the bank and to log in using the banks net banking portal

- Once logged in to the account you are able to check the bank balance of the account from the Dashboard.

Note- Not all the banks are offering this facility to check the Sukanya Samriddhi Yojana Account, therefore, it is recommended to update the bank passbook as it can also help you in filling the Income Tax Return

FAQs and FACTS About Sukanya Samriddhi Yojana

A. For the year 2019 interest rate is declared 8.5% for Sukanya Samriddhi Yojana. The scheme was launched with 9.1% in 2014. For detailed year wise interest rates, please refer interest rates section above.

A. The interest rate is calculated yearly on the yearly compounded basis. That means you will earn interest at the end of the year on (The amount you deposited in the year) + (Previously deposited amount, if any + (Previously earned interest, if any). To calculate the Sukanys Samriddhi Yojana you can download the Excel calculator from above.

Yes, you can make withdrawals when your child attends 18 years of age. The withdrawal limit is set to 50% of the total account balance till the end of the last financial year.

Premature closure is allowed but in case of death of the depositor. Bank can also allow premature closure of SSY account in some extreme conditions subject to Bank’s satisfaction.

No, According to the RBI guidelines NRI cannot open an account under this scheme in any banks or post office.

No, there is no loan facility available with this account.

No, only one account for one girl child. But, you can open two different accounts for two girl child.