Claim Settlement Ratio is an indicator of the total death claims settled by a Life Insurance Company during a particular fiscal year. This ratio is calculated according to the total number of received claims with regards to the actual number of claims settled. For example, if in a specific year the Life Insurance Company received a total of 100 claims and the organization was able to successfully settle 97 of them, then here the Claim Settlement Ratio would be 97 percent. The ratio shows that 3 percent of the claims were rejected by the organization due to some reason. This ratio assists in providing the true picture of an organization and shows its level of customer satisfaction with regards to a death claim.

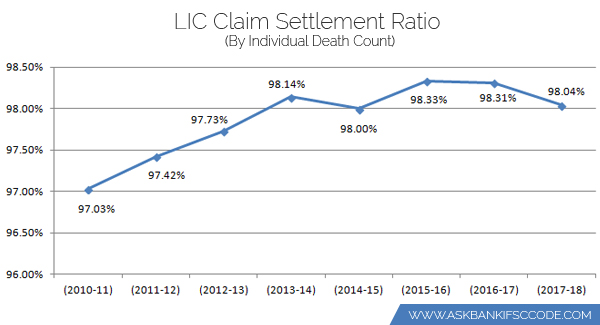

LIC is one of the largest insurance company in India. LIC is one of the best performer when it comes to claim ration. Below is the claim ratio by count of individual death claims for last 10 years.

| Financial Year | Percentage |

| 2010-11 | 97.03% |

| 2011-12 | 97.42% |

| 2012-13 | 97.73% |

| 2013-14 | 98.14% |

| 2014-15 | 98.00% |

| (2015-16 | 98.33% |

| 2016-17 | 98.31% |

| 2017-18 | 98.04% |

It must be noted that in many instances the projected Claim Settlement Ratio is just a raw data and not the true fact. Just by looking at an organization’s Claim Settlement Ratio, a visitor would not know the type of products settled by them. The ratio could denote a Term Insurance Plan, a ULIP Plan, or even an Endowment Plan. Thus, the Claim Settlement Ratio is not a singular measure in adjudicating the performance of a life insurance organization.

IRDA divides its Claim Settlement Ratio in three categories.

- Settled = Claims Settled/Total No. of Claims Reported* 100

- Rejected = Claims Rejected/Total No. of Claims Reported* 100

- Pending = Claims Pending/Total No. of Claims Reported* 100

Why Claim Settlement Ratio Matters?

The insurance companies work on trust factor. Policy holders pay premiums on a regular basis and on the expiry of the term or in the instance of an unforeseen occurrence, the company settles their claims. The settlement of claims is vitally important in the instance of life insurance since in these cases, the policy holders want to ascertain that in the case of their premature demise, their families are able to maintain their expected lifestyle. Hence, the timely settlement of claims enhances policy holder’s trust and this result in customer satisfaction. Similarly, a delayed or non-settlement of claims works in an adverse manner with regards to customer trust.

Other Insurers Claim Settlement Ratio for last five years

The below given report is based on the

individual death claim number published every year by IRDAI in its Annual

Report.

| Company | 2016-17 | 2015-16 | 2014-15 | 2013-14 | 2012-13 |

| Max Life | 97.81% | 96.95% | 96.03% | 93.86% | 94.25% |

| HDFC Standard | 97.62% | 95.02% | 91% | 94.01% | 95.76% |

| Aegon Religare | 97.11% | 95.31% | 90% | 81% | 66.82% |

| SBI Life | 96.69% | 93.39% | 89% | 91.06% | 94.41% |

| ICICI Prudential | 96.68% | 96.2% | 94% | 94.01% | 96.29% |

| Exide Life | 96.4% | 89.36% | 86% | 83.16% | |

| TATA AIA Life | 96.01% | 96.8% | 95% | 89.68% | 84.46% |

| Canara HSBC | 94.95% | 92.99% | 90% | 86.76% | 88.44% |

| Birla Sunlife | 94.69% | 88.45% | 96% | 87.76% | 82.55% |

| Reliance Life | 94.53% | 93.82% | 84% | 81.97% | 86.45% |

| Edelweiss Tokio | 93.29% | 85.11% | 57% | 60% | 45.45% |

| Bharti Axa Life | 92.37% | 80.02% | 81% | 88.13% | 89.48% |

| Bajaj Allianz | 91.67% | 91.3% | 92% | 91.29% | 88.67% |

| Kotak Mahindra | 91.24% | 89.09% | 91% | 90.69% | 92.04% |

| DHFL Pramerica | 90.87% | 83.64% | 57% | 22.14% | 27.04% |

| Aviva Life | 90.6% | 81.97% | 83% | 84% | 67.35% |

| IDBI Federal Life | 90.33% | 84.79% | 72% | 90.34% | 80.06% |

| Sahara Life | 90.21% | 90.3% | 90% | 90.19% | 84.71% |

| Future Genrali | 89.53% | 90.26% | 84% | 74.88% | 70.53% |

| PNB Metlife | 87.14% | 85.36% | 93% | 90.24% | 83.87% |

| Star Union Daichi | 84.05% | 80.73% | 94% | 92.86% | 89.7% |

| India First Life | 82.65% | 71.87% | 72% | 73.13% | 71.4% |

| Shriram Life | 63.53% | 60.24% | 67% | 67.69% | 67.35% |

IRDA Claim Settlement Ratio Report 2017-18

Given below is the IRDA Claim Settlement Ratio for the financial year 2017-18 sorted by Claim Ration percentage.

| Life Insurance Companies | Total Number of Claims | Claims Paid | IRDA Claim Settlement Ratio 2017-18 |

| Max Life | 10332 | 10152 | 98.26% |

| LIC of India | 739082 | 724596 | 98.04% |

| Tata AIA Life | 2850 | 2793 | 98.00% |

| ICICI Prudential Life | 11459 | 11216 | 97.88% |

| HDFC Standard Life | 12566 | 12289 | 97.80% |

| Bharti Axa Life | 888 | 860 | 96.85% |

| Exide Life | 3357 | 3250 | 96.81% |

| SBI Life | 18885 | 18274 | 96.76% |

| DHFL Pramerica Life | 592 | 572 | 96.62% |

| Aditya Birla Sun Life | 5491 | 5292 | 96.38% |

| Aegon Life | 554 | 530 | 95.67% |

| Edelweiss Tokio Life | 189 | 180 | 95.24% |

| Canara HSBC OBC Life | 837 | 797 | 95.22% |

| Reliance Nippon Life | 8987 | 8553 | 95.17% |

| Aviva Life | 1118 | 1056 | 94.45% |

| Kotak Mahindra Life | 3074 | 2881 | 93.72% |

| Future Generali Life | 1291 | 1202 | 93.11% |

| Star Union Daichi Life | 1241 | 1145 | 92.26% |

| Bajaj Allianz Life | 14315 | 13176 | 92.04% |

| IDBI Federal Life | 1161 | 1068 | 91.99% |

| PNB Met Life | 4089 | 3726 | 91.12% |

| India First Life | 1810 | 1626 | 89.83% |

| Sahara Life | 672 | 556 | 82.74% |

| Sriram Life | 3146 | 2524 | 80.23% |

Although Claim Settlement Ratio is an important factor to know the trustworthiness of any organization, yet, if you are honest and disclose all the information on the time of policy purchase, then you do not need to worry about the Claim Settlement Ratio of insurance companies. In the usual course, all insurance companies would honour a genuine claim. However, if you suffer from an injustice despite being honest at the time of policy purchase, then you can take the assistance of the appellate forums such as Insurance Ombudsman and Consumer Court to get justice.

However, if you had hidden certain important factors with regards to your health such as the status of your health, smoking habit, or your occupation then there is genuine reason to worry with regards to Claim Settlement, for in such cases the chances of claim rejection turns high. Although an insurance company have a clause of three years, still it can reject your claim if it is able to prove that certain facts were withheld at the time of policy purchase to take advantage out of the insurance policy.