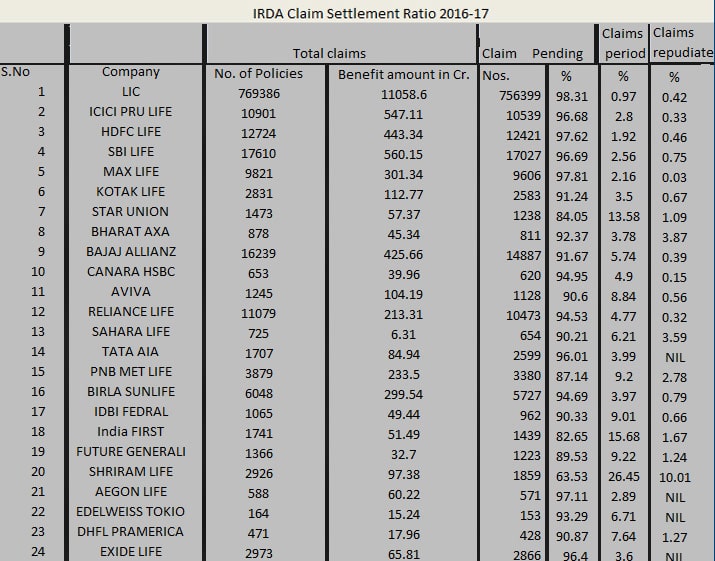

Insurance Regulatory and Development Authority of India (IRDA) is an organization that regulates the insurance and reinsurance industry in India. IRDA is constituted by the Insurance Regulatory and Development Authority Act, 1999 an Act of Parliament passed by the Government of India. Every year IRDA publish claim settlement ratio. The claim settlement ration for the year 2016-17 is stated below-

What is the claim settlement ratio?

Claim settlement ratio is an index that is calculated in order to get detailed info on death claim settled by the life insurance company in the financial year. It can be calculated as the total number of claims received against the total number of claims settled.

IRDA Claim Settlement Ratio 2016-17

Claim settlement ratio is as of 2016-17 is given below-

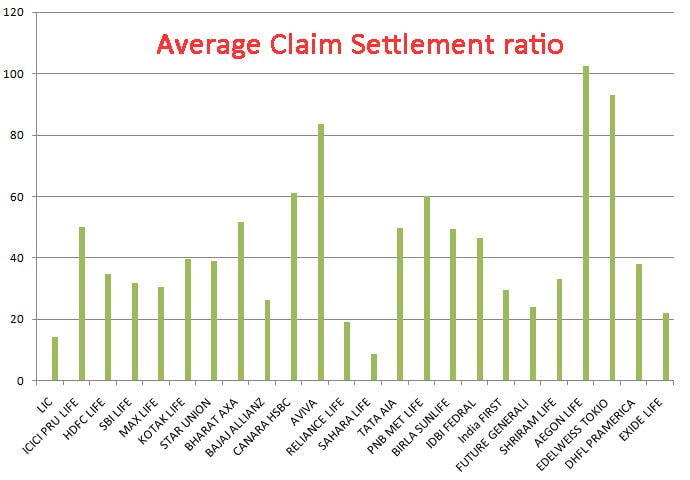

Average Claim Settlement Amount of Life Insurance Companies in 2016-17

The Average Claim settlement amount given by the life insurance company will tell us the type of product the companies have settled. It is one of the main factors that evaluate how the company deals with the customer regarding the product of different segment.

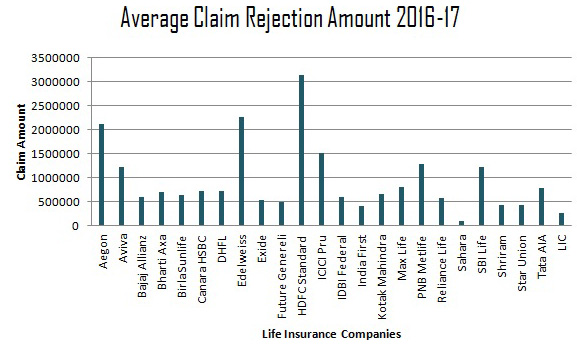

Average Claim Rejection Amount of Life Insurers in 2016-17

The average claim rejection amount is provided above and the above chart shows us that the Sahara life insurance company’s claim rejection amount is low and then comes the LIC. However, the no of claim it deals with is high and the amount is less.

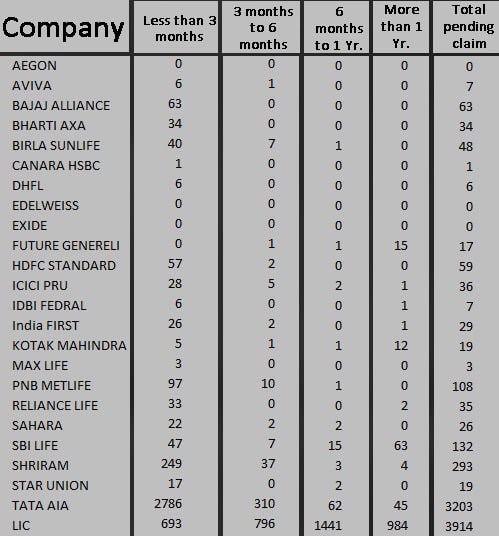

Claim Pending Status of Life Insurance Companies in 2016-17

Claim Pending status of the life insurance will tell us on how the life insurance companies will settle the request. This becomes important because the faster they settle the amount the better it becomes to deal with the situation of the customer. In this regards below is the following chart showing the claim settlement status for pending cases.

Best Life Insurance Company in 2018

By evaluating the above data it is clear that the 5 best performing life insurance companies in terms of customer satisfaction are as follows-

All these life insurance companies are good at settling the claim when in need and also the trust in these companies is good when it comes to dealing with the toughest moments.