In an ever-increasing effort to deliver the best possible services, the State Bank of India has initiated the Positive Pay System (PPS) to provide an extra-level of security. As per this system, the issuer of the cheque would require to submit detailed cheque information. While it is a little hassle on the customer front, the end result is enhanced security and a surety that only the valid cheques would get cleared. The cheque details needed by the bank include payee name, amount, date of issuance, cheque number, and account number. SBI account holders have the provision to submit the details either through mobile banking or via net banking.

What is Positive Pay?

Bank account holders can become victims of fraudulent fiscal activities including the issuance of a fake cheque. There are several ways a cheque can be misused. Criminals can create counterfeit cheques. A vendor presented with a cheque could add extra numbers to increase the payable amount. Or any other mishap could happen. To save the SBI account holders from financial catastrophes, the bank offers the Positive Pay feature to ensure that a cheque is only cleared if it complies with all security checks.

Positive Pay ensures that all cheques are valid and sends them for clearance only after getting a confirmation on their authenticity. It is a popular cash management system employed by prominent banks for fraud detection. The automated tool is supervised by the Cash Management Department and used as an approach to assure safe service and save customers from losses against possible fraudulent activities.

The system operates by checking the rupees amount of every individual cheque along with the account number and the cheque number that has been presented for payment by the sanctioned authority. In case, there is any form of discrepancy, the bank would flag the cheque and notify the customer on the cheque status.

How Does Positive Pay Work?

To safeguard the account holder from counterfeit, forged, or altered cheques, the positive pay service compares specific data of the cheques against a company-provided list before sending it for clearance. The data checked by the bank includes exact sum of money issued in the cheque, cheque number, date of issuance, payee, and account number. If any one of the data shows a failed match result, the cheque would be flagged and the bank would not clear it. The customer is then notified about the rejected cheque along with the reason for rejection through an exception report. The cheque would be withheld for payment until the customer informs the bank whether they want it to accept or reject the transaction.

In case of minor error, the customer could suggest the bank to clear the cheque.

Steps to Submit SBI Positive Pay Online through Mobile Banking

You can submit State Bank of India Positive Pay online through mobile banking using YONO or YONO Lite app. The steps to do so are as follows:

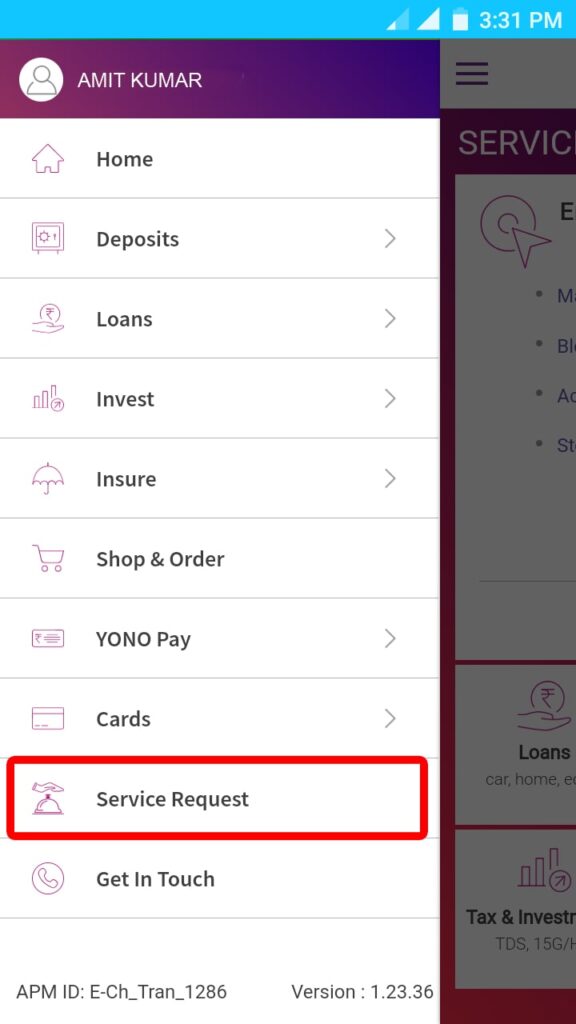

- Open the SBI YONO App

- Log in with the help of your credentials

- Open the “Services Request” tab

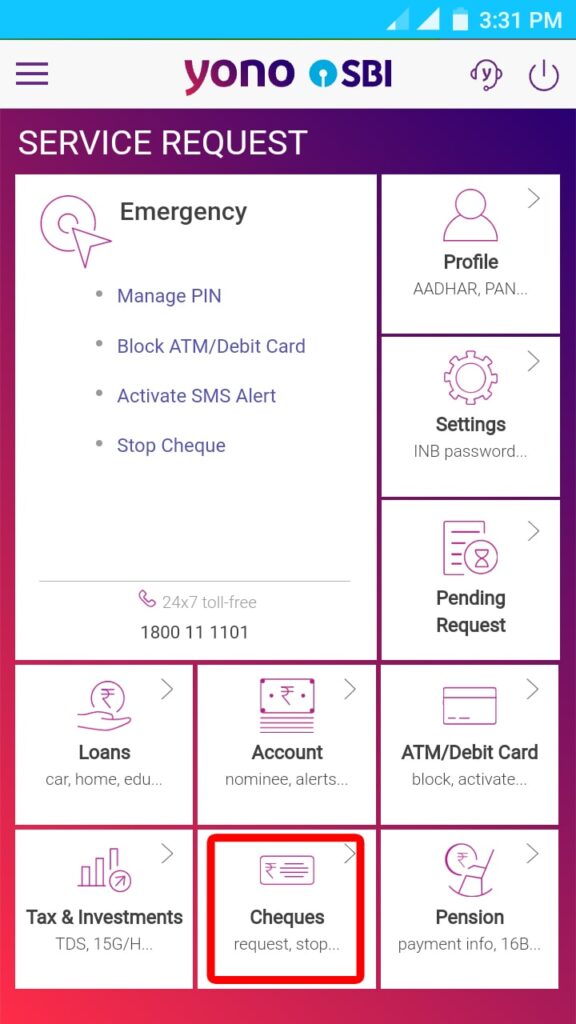

- Select “Cheque” option

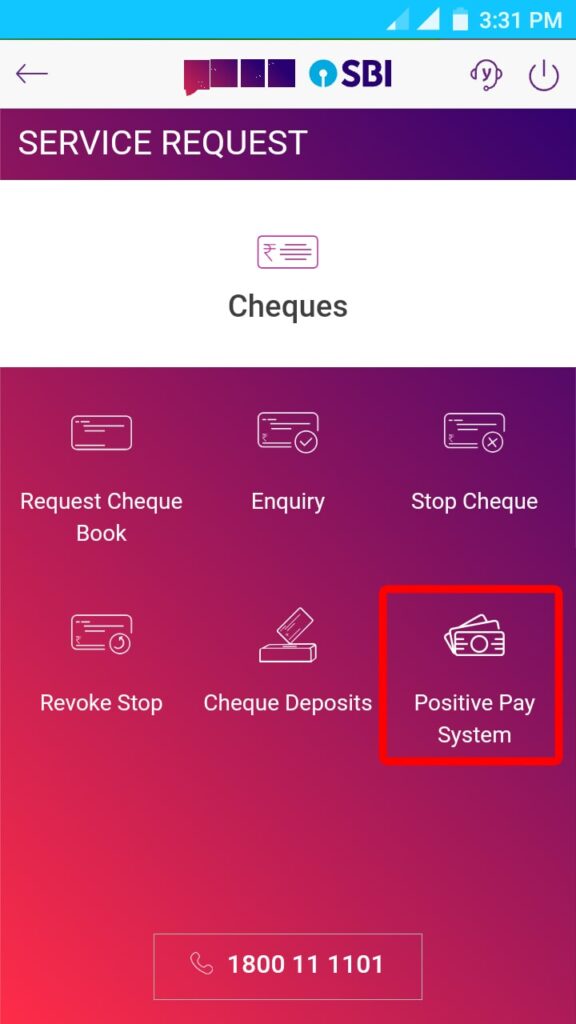

- Click on “Positive Pay System”

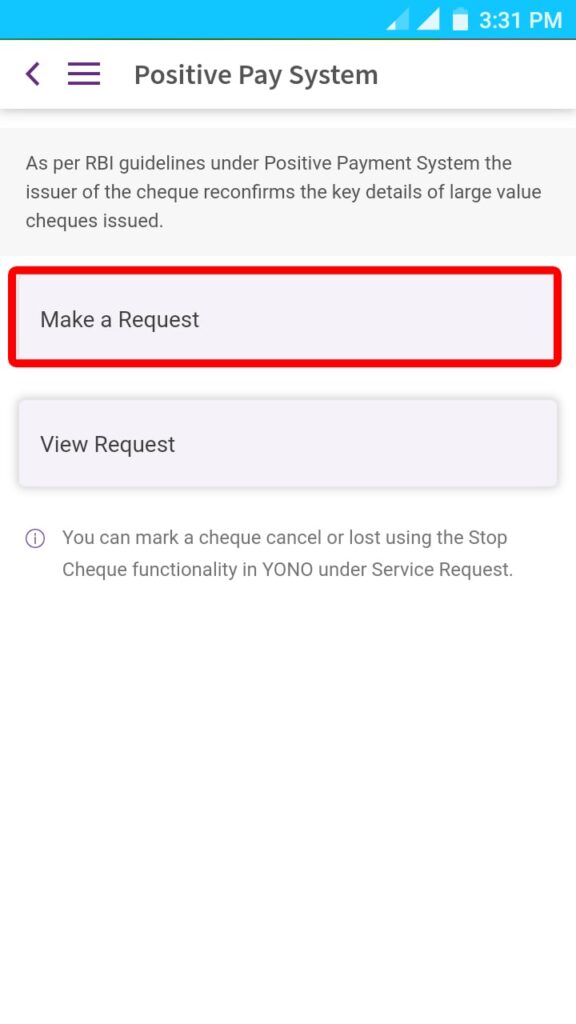

- Next select “Make a Request” option

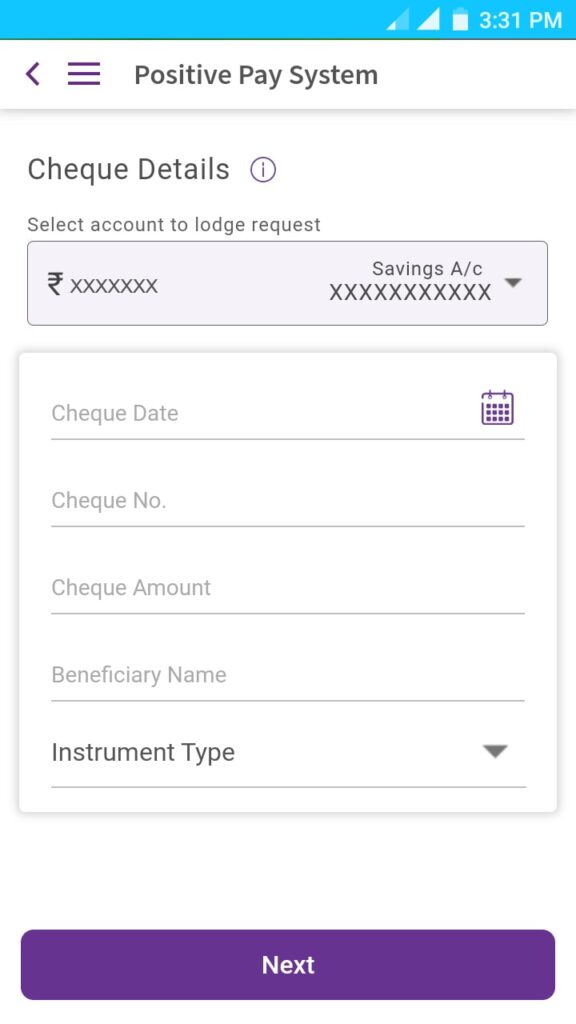

- Select the Account, in case of multiple accounts and fill the required details e.g. cheque number, amount, beneficiary name, amount etc and click on next to submit.

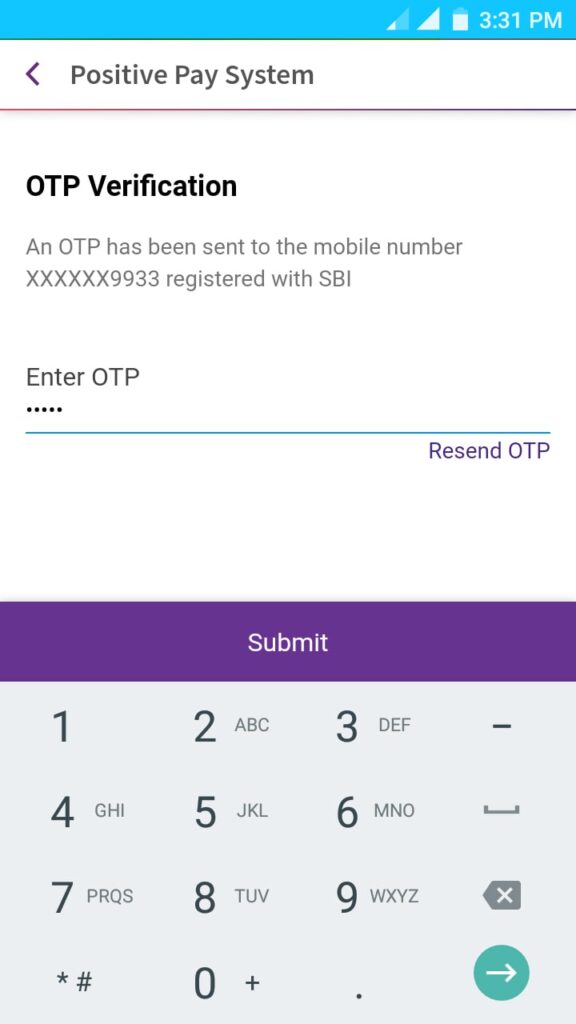

- System will validate transaction with OTP and you will receive the same on your registered mobile number.

- Submit the OTP and you are done.

Steps to Submit Positive Pay in SBI through Online Banking

You can also submit the Positive Pay requirements through online banking. The steps to do so are given under.

- Open the page onlinesbi.com

- Log in using your customer ID and password

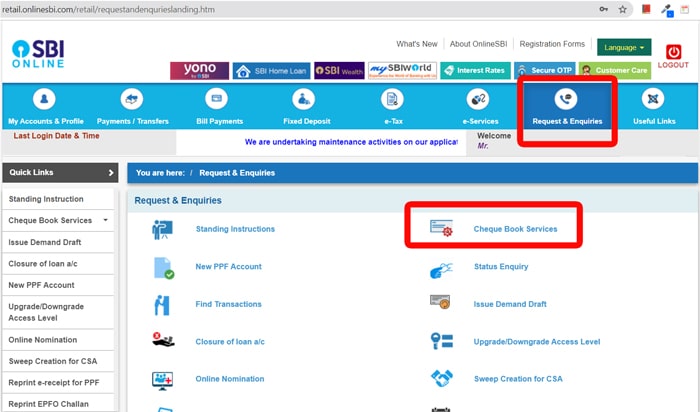

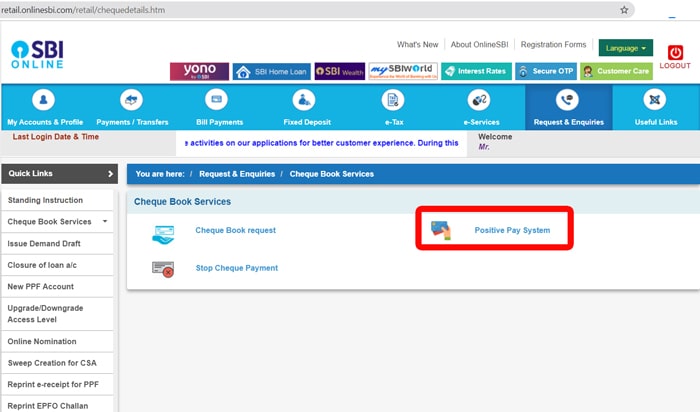

- Select the tab Cheque Book Services

- Click Positive Pay Services

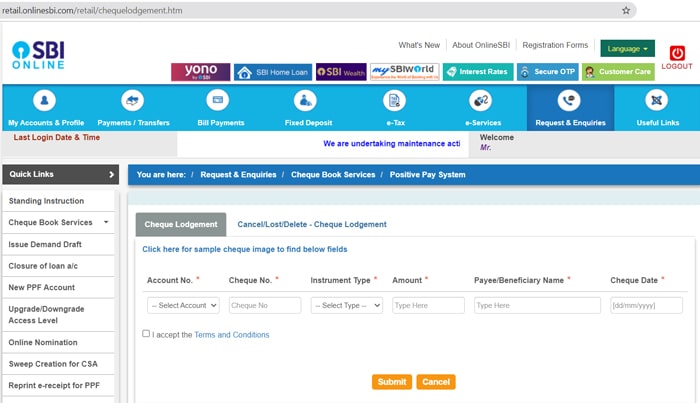

- Choose your account number

- Fill in the appropriate details like payee name, cheque date, amount, instrument type, and cheque number

- Submit

Benefits of SBI Positive Pay Cheque process by RBI

Positive Pay Cheque facility is beneficial for both the beneficiary and the issuer of the cheque. The issuer gains by being saved from any forgery attempt against the cheque or his bank account. Consequently, no amount of money can leave his account without a double check. The beneficiary gains by honoured cheque that doesn’t suffer from any clearance issues.

FAQ

Ans: Positive Pay is a tool to detect and prevent frauds with respect to criminal use of cheque. It helps in safeguarding the account holders’ money where no cheque would get cleared without a double check from the concerned authorities.

Ans: At present, Positive Pay is an optional tool.

Ans: The Positive Pay request can be viewed or cancelled online via mobile banking (YONO or YONO Lite) or net banking facility.

Ans: Apart from comparing the issuance date, amount of money filled in the cheque, account number, and cheque number, there is a mandatory column for Payee Name Match. The column is meant to review all issued cheque payees. In case of any discrepancy, the cheque would be flagged and sent for reviewal by the bank.

Ans: Positive Pay helps in instant identification of mismatched cheques and fraudulent account activities. Its feature of Cheque Reconciliation providers the account holder with a summary of outstanding, void, paid, and issued cheques.

Ans: Exceptions could arise from any of the below mentioned circumstances.

Cheque file is incomplete or not loaded into the system

Cheque listing is absent on the issued cheque file

Duplicate files of cheques previously paid

Unmatched cheque number

Unmatched listing of payable amount

Unmatched payee name

Fraudulent cheque

Unmatched date

Ans: The concerned account holder would be notified via an SMS text message on the registered mobile number and the registered email account.

Ans: Definitely. Positive Pay permits users for multiple users’ entitlement rights. Here each authorized user would have the right to either upload your data file or cheque register, return or pay unauthorized cheques or even do both.