Tracking your bank account finances helps you in budgeting your expenses and savings and to do that you would need to know your bank balance.

Traditionally, the banks provide passbook that can be used for checking bank balance however, in this age of digital banking, you do not need to visit the bank branch to find your bank balance.

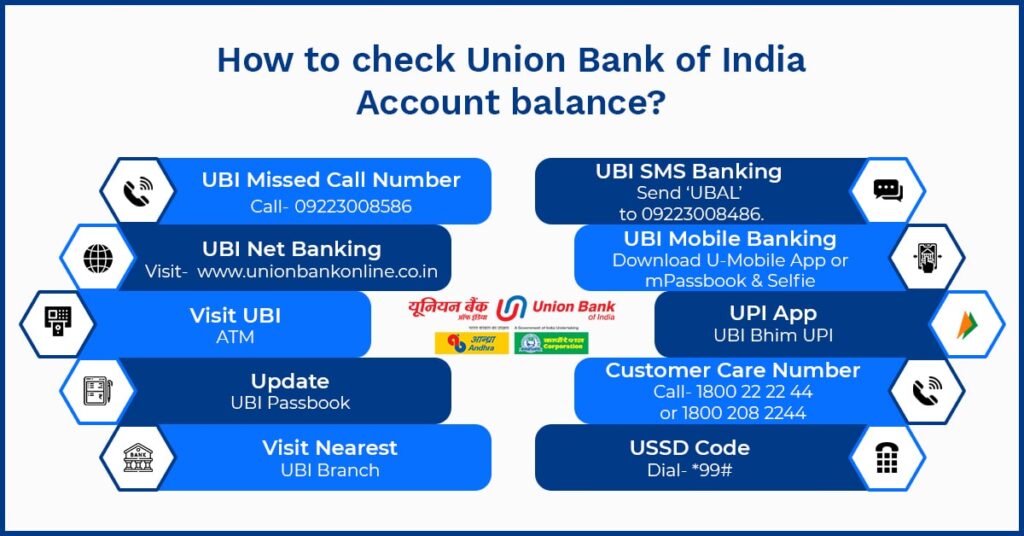

You can use various methods to check the Union Bank of India bank balance within the comfort of your home using mobile service and the internet. Read the guide below to know the different ways how to check the Union Bank of India Account Balance.

Union Bank of India Balance Inquiry Number

Missed call service is one of the easiest methods to check your account balance. However, to avail of this facility, you need to have your mobile number registered with the bank.

You can register your number by calling the customer care service (1800 22 22 44 / 1800 208 2244) or by connecting with your branch. Once registered, you can check the account balance by giving a missed call to 09223008586. The balance amount would be notified to you in the form of an SMS.

Union Bank of India Mini-statement Missed Call Number

You can use the Union Bank of India mini-statement using a missed call number to find the last 5 transaction details. Give a missed call on 0922-300-8586, after which your call will be automatically disconnected and you’ll receive an SMS containing the last 5 transactions details.

SMS Banking via Union Bank SMS Balance Check Number

SMS Banking is a safe, reliable, and convenient service that updates you with instant notifications regarding account transactions. Hence, it gives 24X7 service and empowers you to be vigilant towards your bank account.

Every debit or credit in your account over a limit desired by you is intimated by SMS. You can also use SMS banking to check your account balance. To avail of this facility, you need to have your mobile number registered with the bank.

As stated under the sub-heading ‘Missed Call Service,’ you can register your number by calling the customer care service (1800 22 22 44 / 1800 208 2244) or by connecting with your branch.

While doing so, remember to have your Account Number or Debit Card number available with you to furnish the essential details.

If you have just a single account with Union Bank of India, then you need to send the message “UBAL” to 09223008486 from your registered mobile number. If you have two or more bank accounts registered with the Union Bank of India, then

- For primary account balance, send UBAL to 09223008486.

- For other account balances, send UBAL<space>Account number to 09223008486.

For receiving the last 5 transactions, customers can type “UMNS” and send it to 09223008486.

Net Banking

Union Bank of India has a safe and effective 24X7 internet banking service. hence, you can log into the site www.unionbankonline.co.in from the safety of your home and check your account balance.

The internet banking facility allows you to check account(s) and transaction details, view and print account statements, transfer funds to own or third-party accounts within the bank or to other Indian bank accounts through NEFT/RTGS facility, and carry out direct and indirect tax payments, pay utility bills (electricity bills, telephone bills, insurance premium payments, mutual fund payments, credit card payments, etc.), and book railway and air tickets.

You can activate internet banking service via the following channels:

- If you have a Union Bank of India ATM cum Debit card, then you could create an internet banking user id and password by visiting the website’s Self User Creation module. You could also self-generate and reset the passwords through the Self Reset Password module.

- If you do not have an ATM cum Debit card, you can still create an internet banking user id and password via the Self User Creation module without ATM Card on the website. In this case, you would just have the viewing view rights. Later on, if you desire then you can apply for Transaction Password via Forgot/Reset Password Page.

- If you have a corporate account, then you can only apply via the branch with the Internet Banking application format.

Mobile Banking

UBI extends its customers the facility of mobile banking via a range of user-friendly mobile apps. To avail of this facility, your number must be registered with the bank.

You can register your phone for mobile banking services by applying for the same at your nearest Union Bank of India branch. Once registered, you would receive a mobile Id and password to get started on this facility.

Now download the suitable app from your Google Play Store or Apple App Store to easily check your account balance and enjoy other services. The popular UBI mobile apps are U-Mobile App, mPassbook & Selfie, Union Sahyog, and Digi Purse

U-Mobile App:

It is a free, user-friendly app and a very convenient method to check the Union Bank of India account balance. The app also allows you to get account statements, transfer money (self and third-party) to accounts in Union Bank of India or other banks, perform Immediate Payment Service (IMPS) transactions, request for a cheque book, request for a loan, make a bill payment, have mobile recharge, book movie and show tickets, book domestic and international flight tickets, and engage in numerous money transactions for a maximum everyday cumulative value of Rs 50,000.

mPassbook & Selfie:

It is the electronic version of the physical passbook and allows the facility to check the existing account balance.

Even if you are not a member of the Union Bank of India, still you can download the app and instantly open up a UBI account using the Aadhaar card, PAN number, and mobile number.

If you have more than one UBI account, then you need to open an account for all of them to check the account balance.

- Union Sahyog: The app has multiple features including ‘Balance Enquiry’ call button. Once clicked, it triggers a phone call to notify you about the account balance.

- DIGI PURSE: It is Union Bank of India’s own mobile wallet. It allows you to engage in balance enquiry, shopping, recharge, and bill payments.

ATM Visit

ATMs are not just meant for withdrawing money. They serve numerous other purposes including the facility of balance inquiry.

You can visit the nearest ATM of Union Bank of India and use the “Balance Enquiry” option to check the current account balance. The steps to do it are as follows:

- Put the ATM cum Debit card in the allotted ATM slot.

- On getting the prompt, enter the 4-digit ATM PIN.

- From the menu, choose the “Balance Enquiry” option.

- You will receive the existing balance information in the paper format.

Note: You do not actually need to go to a Union Bank of India ATM, as the information can also be generated through the ATMs of other banks. You can also use the Mini Statement option to check the last ten transactions.

Passbook Update

Physical passbooks are the oldest and the most convenient approach to maintaining a balanced record. Hence, every time you engage in a transaction (credit or debit), you can maintain the same in the passbook and know about the latest account balance. You can also visit the local UBI branch to have your passbook updated.

Branch Visit

It is a time taking method, but if you are going to the bank for any purpose, then you can easily have your passbook updated and know about the latest Union Bank of India account balance.

UBI USSD Service

You could dial *99# from your registered mobile number and follow the steps instructed by the USSD service to check the account balance. This service is meant for customers who do not possess a smartphone and have not registered for mobile or net banking.

UPI Apps

Union Bank of India has launched a UPI-enabled app to facilitate its customers with a secure banking facility. Once you register for this app, you would be sent a Virtual Payment Address (VPA) in the form abcd@uboi or abcd@unionbank.

Hence, you can engage in money transactions without the need to share your actual account details like account holder name, account number, and IFS Code. The “View Balance” feature allows you to enquire about the existing bank balance.

Call Customer Care

Customer Care is one easy facility to instantly approach the Union Bank of India executives and have all your concerns answered and resolved. You can call Customer Care Centre anytime 24x7x365.

This delivery channel offers banking facilities via Interactive Voice Response (IVR) along with a human interface through connection with a Call Centre executive. The call could be taken in any of the seven available regional languages of choice that include Telugu, Tamil, Kannada, Bengali, Gujarati, Marathi, and Malayalam) besides Hindi and English.

The services provided by IVR include account information, balance check, and the last five transactions. It saves you the trouble of talking to an agent. However, to avail of this feature, your phone must be registered by the bank.

The IVR also helps you to hotlist or remove the debit cards, seed your Aadhar number, stop cheque payment, and others.

All-India Toll-Free number: 1800 22 22 44 / 1800 208 2244

Charged Numbers: 080-61817110

Dedicated number for NRI: +91 8061817110

About Union Bank of India

Union Bank of India is one of India’s top public sector banks with its headquarters in Mumbai (India). It is a listed entity with 89.07 shares in the hands of the Government of India. The bank was registered on November 11, 1919, as a limited company. Presently, it has 75000+ employees serving over 120 million patrons. It has more than 9500 domestic branches, 13300 ATMs, and 11700 BC Points. The bank has extended its offices overseas with branches in Hong Kong, UAE, and Australia. It is India’s first large public sector bank to implement a 100 percent core banking solution. Hence, Union Bank of India strives continuously to make the banking needs of its customers simpler and offers several options to check the account balance.

FAQs

Ans. UBI customers can give a missed call on 09223008586 to receive the account balance update via SMS.

Ans. You type “UBAL” and send it to 09223008486 to receive an SMS reply with the account balance details.

Ans. Yes, a mini-statement with the last five transactions could be received by sending an SMS “UMNS” sent to 09223008486.

Ans. If your mobile number is not yet registered for the services, you can do so by calling 24X7 Call Center at 1800 22 22 44 / 1800 208 2244 or contact Branch.

Ans. You can type an SMS “UBRANCH <PinCode> <Location/city> and send it to 09223008486 to get the branch detail.