The Public Provident Fund (PPF) is one of India’s most desired retired savings scheme for working class population. The extensive investment duration with compounding interest acts as the chief attraction to invest in this scheme. Another advantage of PPF is its nature of tax exemption on the interest earned on the account. It allows investors to enjoy healthy savings at the time of retirement.

Opening a PPF is easy and State Bank of India (SBI) further simplifies the process through activation of digital channels. Read the article further to know how to apply for PPF Account online in SBI.

Public Provident Fund- An Introduction

Public Provident Fund (PPF) is a Government of India backed popular long-term investment option scheme. It provides safety with attractive interest rates, and the deposit qualifies for deduction under section 80-C of the Income Tax Act. However, under Section- 10 of I. T Act, there is no tax on the interest earned on the account. A depositor has the option to save up to Rs. 1,50,000 each financial year. Furthermore, you can avail of facilities like account extension, account transfer, partial withdrawals, and loans. It is beneficial for self-employed individuals and people belonging to unorganized sectors as they are deprived of EPF/GPF facilities.

Benefits of PPF

- Attractive rate of interest at 7.1% p.a (financial year 2020- 2021). (Note: the interest rate varies for every financial year)

- Total exemption from income tax on the interest earned on the account under Section- 10 of the Income Tax Act.

- Favourable extensive-duration investment spanning for 15 years.

- Minimum deposit of Rs. 500 and maximum deposit of Rs.1,50,000 for a financial year.

- Monthly instalment option.

- Loan availability between third and sixth fiscal years.

- Option for partial withdrawal from seventh financial year.

- Option to extend PPF after maturity for any number of years constituting a block period of five years.

- Indefinite retention of account without further deposit after account maturity at the existing interest rate.

- The account can be transferred without extra cost to a different branch, a different bank, or Post Office. Conversely, you can also transfer the PPF account from a Post Office or another bank or branch to a particular branch of SBI.

Prerequisites to Opening the PPF Account Online with SBI

- You must have an SBI savings account.

- You must have activated mobile banking and/or net banking access.

- The Aadhaar number must be linked to the bank account.

- The phone number linked to your Aadhaar card must be active at the time the one time password (OTP) is sent to it.

Apply for PPF Account in SBI through SBI Website

- Log into your personal SBI account www.onlinesbi.com using your credentials and the OTP sent to your registered mobile number.

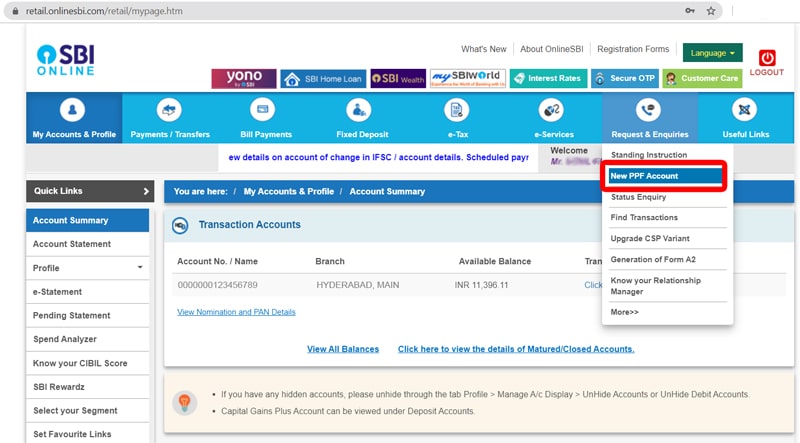

- Go to the Tab “Request and Enquiries,” and click on it.

- A dropdown menu would open up with several links. Click on the second link “New PPF Account.”

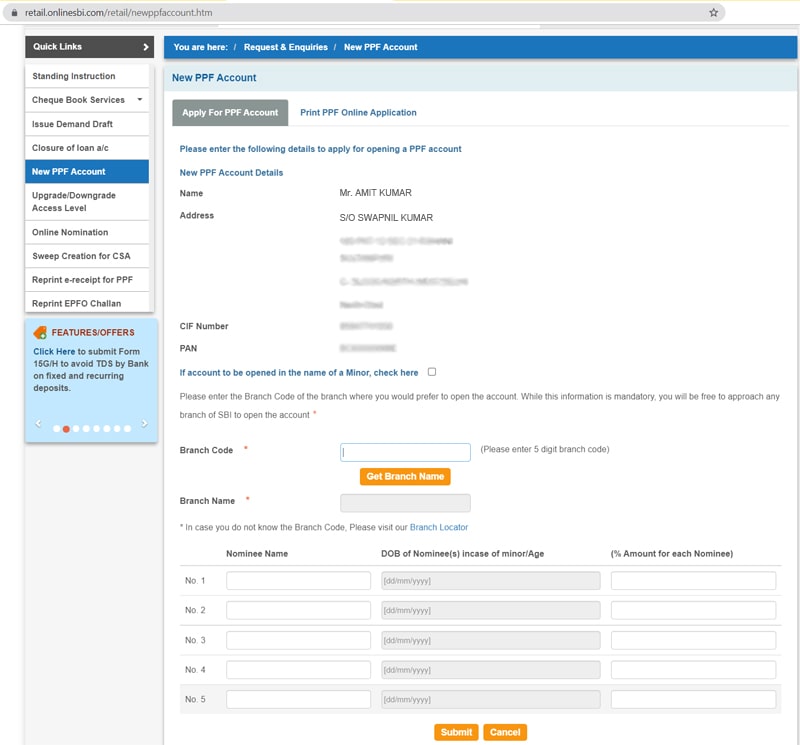

- A new image box would open up with the heading “New PPF Account.” Below it you can find two options- “Apply for PPF Account” and “Print PPF Online Application.” The page would by default open under the former heading. Most of your details like name address, PAN number would be auto filled. You need to enter the branch code, branch name, and the nominee details. There is an option to fill in up to five nominees.

- If you want to open the PPF account for a minor then click on the appropriate checkbox.

- Once all details are entered, hit the “Submit” button.

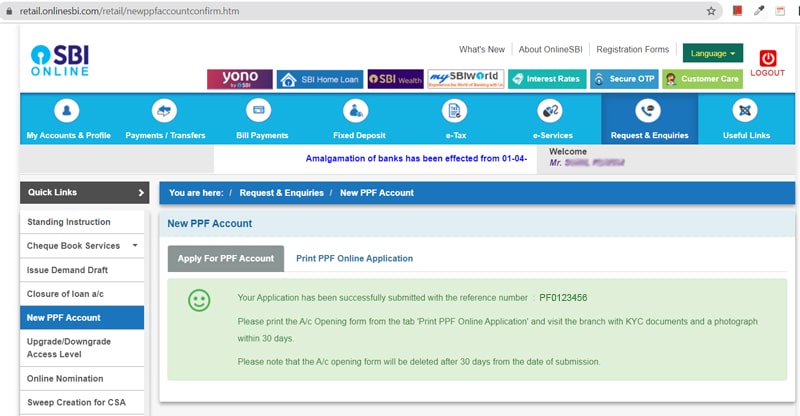

- Your PPF account would be created and you would see the displayed PPF account number. PPF account statements are available on internet banking.

- Click the option ‘Print PPF Online Application’ to get a print of the account opening form. Now visit your nearest branch within a month along with the printed form, KYC documents, and a photograph to complete the account opening process.

Apply for PPF Account Online in SBI through Website

You can apply for PPF Account Online in SBI through its website. The steps are as follows:

- Visit the website https://www.onlinesbi.com/personal/reg_forms.html.

- A page titled “Forms” would open up with options to apply for different services. Scroll down the list. You will find a dropdown box with the heading “Public Provident Funds Form.” Click on it.

- There would be several PDF forms with downloadable options. Choose the topmost option “FORM-A (PPF OPENING).pdf” and click on it.

- A new window would open up containing the form. Download it and fill in all the suitable details like CIF number, account number, PAN number, etc. Affix a passport sized photograph and submit it to the bank for processing.

Apply for PPF Account in SBI through SBI Website

- Log into your personal SBI account www.onlinesbi.com using your credentials and the OTP sent to your registered mobile number.

- Go to the Tab “Request and Enquiries,” and click on it.

- A dropdown menu would open up with several links. Click on the second link “New PPF Account.”

- A new image box would open up with the heading “New PPF Account.” Below it you can find two options- “Apply for PPF Account” and “Print PPF Online Application.” The page would by default open under the former heading. Most of your details like name address, PAN number would be auto filled. You need to enter the branch code, branch name, and the nominee details. There is an option to fill in up to five nominees.

- If you want to open the PPF account for a minor then click on the appropriate checkbox.

- Once all details are entered, hit the “Submit” button.

- Your PPF account would be created and you would see the displayed PPF account number. PPF account statements are available on SBI net banking.

- Click the option ‘Print PPF Online Application’ to get a print of the account opening form. Now visit your nearest branch within a month along with the printed form, KYC documents, and a photograph to complete the account opening process.

Apply for PPF Account in SBI at the Branch

You can apply for PPF account in SBI by visiting the nearest branch of the bank and requesting for the PPF form. Don’t forget to carry the KYC documents and passport size photographs to stick on the form. You can fill in all the details in the bank itself and submit them for processing.