UPDATE on 1 October – All the three banks board members approved the merger to create India’s Third largest bank after SBI and ICICI bank. Bank of Baroda, Vijaya Bank and Dena Bank send a follow-up proposal for the revaluation of the merger to the Government for final approval. After the approval, the process of the merger will begin and it will take at least five-six months.

The Board of the Dena Bank approves the merger with the Bank of Baroda, and Vijaya Bank on 25 September 2018. The Board concluded for the amalgamation of all the three banks. They said that the merger will result in building the country 2nd largest state-run bank after State Bank of India (SBI) which merged it five subsidies along with the Mahila Bandhabamm Bank in April 2017.

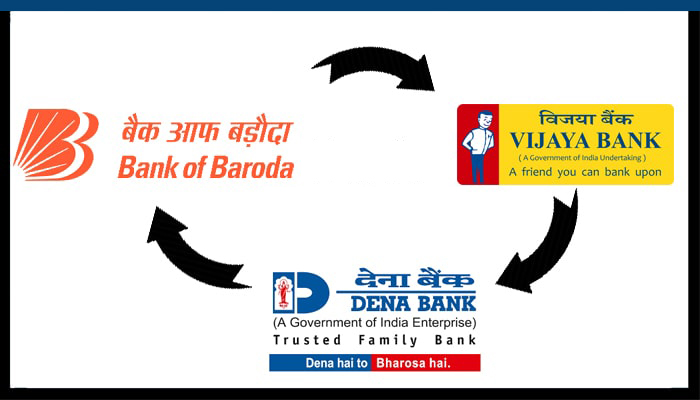

Finance Minister Arun Jaitely representing the Government of India on Monday announced the merger of three public sector Bank- Bank of Baroda, Vijaya Bank and Dena Bank. This is the proposal which was given to the bank board members to provide more and efficient banking to the people all over India. This merger will increase the banking operation in the country. Bank of Baroda is the biggest of the three with Rs 10.29 lakh crore of total business, followed by Vijaya Bank at Rs 2.79 lakh crore and Dena Bank at Rs 1.72 lakh crore. This merger will result in 34% of low-cost deposits, a capital buffer of nearly 12% and a business book of Rs 14.82 lakh crore.

This merger is following the footstep of the State Bank of India merger with its five associate banks and Bharatiya Mahila Bank. The merger is planned in such a way that the combined bank does not end up being weaker than the original entity. This merger will not impact the customer of the bank as well as on the employee.

What changes the merger offers?

This merger of Bank of Baroda, Vijaya Bank and Dena Bank will create a lender with nationwide reach. Bank of Baroda has a widespread reach while Dena and Vijaya bank is regionally focused.

- The advances base of the merged bank will be Rs 6.4 lakh crore

- The deposit base of the banks will be Rs 8.41 lakh crore

- The gross non-performing assets will be approximately Rs 80,000 crore

- The gross NPA ratio will be about 13 percent.

Out of all the three banks, Dena Bank is currently under the Prompt Corrective Action (PCA) framework. It has a gross NPA ratio of 22 percent which is the highest across the industry. Vijaya Bank is among the better performing public sector banks with a gross NPA ratio of 6.9 percent. Bank of Baroda is the largest of the three has a bad loan ratio of 12.4 percent.

The Benefit of the Merger

- Provision coverage ratio (PCR) at 67.5% is well above the PSBs average of 63.7%

- Net NPA ratio at 5.71%

- Gross NPAs for the combined entity at 48.94%

- Dena bank strength in MSME will augment the strength of the other banks.

- Capital Adequacy Ratio at 12.25% above the regulatory norm of 10.875%

- Cost-benefit from synergies

- Access improved through the amalgamation of networks

- A wider range of product and services through leveraging of bank subsidiaries.

The disadvantage of the merger

There is no major disadvantage in the merger of the bank however bank of Baroda and Vijaya bank has to go through a short-term loss. Due to the merger with the Dena Bank, the other banks have to absorb the loss of the Dena bank but in long-term, this merger will benefit all the banks. In the employee and customer front, there is no Impact of the merger on them. However, the process will take at least 5-6 month to execute and may disturb the banking operation.