When we need to find the account balance we either have to find an ATM or we need to visit the bank branch. Axis Bank introduced a Missed Call Balance check that can be used to find the bank account balance by giving a missed call balance.

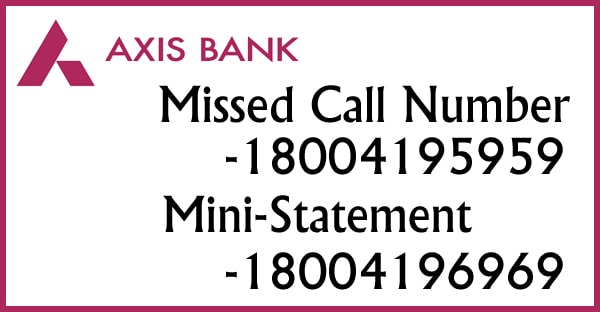

Axis bank Missed Call Number

The Axis bank missed call Number to find the bank account balance is 18004195959. After giving a missed call, the call will be disconnect automatically and an SMS containing the bank balance account details. You can also use the mini-statement number to find the last 5 transaction. The number to find the mini-statement is 18004196969, mini-statement details through an SMS will be sent.

You can also find the details like Missed Call Number and Mini-Statement in Hindi by giving a missed call on 18004195858 and 18004196868 respectively.

About Axis bank

Axis Bank is a private sector bank that is the third largest private bank with 4137 bank branches in India. The bank is formerly known as UTI Bank. Apart from the missed call balance you can also use the following ways to find the bank account balance-

- Axis bank SMS

- Axis bank Net Banking

- Axis Bank Mobile Banking

- Axis Bank ATM

Axis bank SMS

You can request to get the bank balance details by sending an SMS with a pre-defined syntax on 5676782 or 9717000002. Axis Bank SMS Banking also offers other services like mini-statement, Cheque book request etc. These are the following syntax that can be used to find the respective details-

| Request | SMS Message |

|---|---|

| Balance Enquiry | BAL [account-number] |

| Last 3 transactions | MINI [account-number] |

| To locate the nearest ATM | ATM <Pincode> |

| To download Mobile App | MBANK |

| To register for E-Statement | GREEN <Email Id> |

| On-Demand E-statement | ESTMT<last 5 digits of account number> <From Date> <To Date> – Dates in dd-mm-yyyy format |

| Update Email ID | UPDATEM<valid Email ID> |

| To get a Cheque Book | CHQBK <Last 6 digit of a/c No.> |

| Cheque Status Enquiry | CHQST <6 digit of Cheque No.> <Last 6 digit of the A/c No.> |

| Stop Cheque Request | STOPCHQ<6 digit of Cheque No.> <Last 6 digit of the A/c No.> <3 digit reason code> Reason Code 019 – Cheque Book lost 020 – Cheque Book mutilated 021 – Cheque Book stolen 022 – Cheque forged 023 – Cheque lost 018 – Cheque Book not received 016 – Others 017 – Wrong amount spelt |

| Prepaid Mobile Recharge | MOBILE < mobile number > < operator name > < amount > < last 6 digits of your axis bank acct no. > |

| Prepaid DTH Recharge | DTH < Customer ID > < operator name > < amount > < last 6 digits of your axis bank acct no.> |

| Prepaid Data Card Recharge | DATA < Data card number > < operator > < amount > < last 6 digits of your axis bankacct no.> |

| Know your MMID | MMID |

| To update PAN number | PAN <Pan number> < Customer ID > |

| To know your Projected Average Balance | SMS:PAMB < last 6 digits of AC no. > |

| For Projected Average Quarterly Balance | PAQB < last 6 digits of AC no. > |

| Average Half Yearly Balance | PHAB < last 6 digits of AC no. > |

Axis bank Net Banking

Net banking is one of the best banking services that are used to do all the banking within the comfort of our home. Net Banking uses the internet to do banking like fund transfer and much more. There are two different type of net banking login provided by the Axis Bank-

Axis Bank Mobile Banking

Mobile Banking is the similar to net banking but you do it on your Smartphone. The Download links for the respective devices are provided below-

Axis Bank ATM

ATM card can be used to find the bank balance using ATM Machines. It is a free to use service and can be used on any ATM Machine. You can use the following steps to find the Bank balance-

- Insert your ATM card in the ATM Machine

- The ATM Machines ask you about the PIN

- After entering the PIN select the Balance inquiry option

Minimum Balance Requirement of Axis Bank

Every Bank has a minimum balance requirement cap that has to be maintained by the account holder to keep his account operations smooth. The minimum balance requirement of the Axis Bank is as follows-

| Savings Account Type | Minimum Balance Amount |

|---|---|

| EasyAccess Savings Account | Rs.10,000 |

| Prime Savings Account | Rs.25,000 |

| Future Stars Savings Account | Rs.2,500 |

| Prime Plus Savings Account | Rs.1,00,000 |

| Women’s Savings Account | Rs. 10,000 |

| Senior Privilege Savings Account | Rs. 10,000 |

| Pension Savings Account | Nil |

| Trust/NGO Savings Account | Rs. 25,000 |

| Insurance Agent Account | Rs.5,000 |

| Youth Account | – |

| Basic Savings Account | Nil |

| Small Basic Savings Account | Nil |

| Krishi Savings Account | Rs. 2.500 (half-yearly) |

Charges for Non-Maintenance on the Minimum Balance

| Location | Charges |

|---|---|

| Metro/urban | Rs. 350 or Rs. 5 for every 100 rupees shortfall whichever is lower |

| Semi urban | Rs. 350 or Rs. 5 for every 100 rupees shortfall whichever is lower |

| Rural | Rs. 750 or Rs. 5 for every 100 rupees shortfall whichever is lower every 6 months |